Verifi specializes in dispute management, aiding sellers in revenue retention and cost reduction from banks.

- Resource

- /

- How 3D Exemptions Streamline Checkout Without Sacrificing SCA Compliance?

Contents

Recommended Articles

What is Payment Orchestration? A Complete Guide for Businesses in 2026

December 9 2025 | Blog

A Payment orchestration is a software layer that connects your business to multiple payment service providers, acquirers, banks and other financial services through a single platform, it allows you to manage transactions across various partners and optimises success...

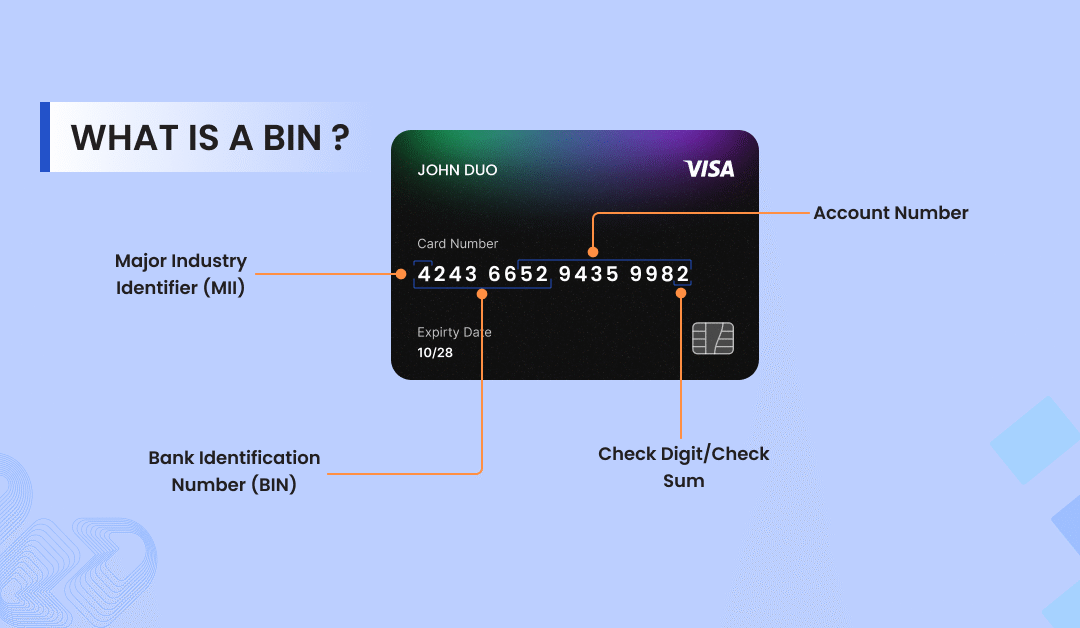

What is BIN in Card Payments? A Guide Every Merchant Need

November 26 2025 | Blog

Most businesses today close sales through conversations, not just via websites or apps. Customers interact with your brand across various channels, including Instagram, WhatsApp, email, and live chat.

Pay by Link: A Smarter Way to Accept Payments in 2025

July 31 2025 | Blog

Most businesses today close sales through conversations, not just via websites or apps. Customers interact with your brand across various channels, including Instagram, WhatsApp, email, and live chat.

Share This Post

How 3D Exemptions Streamline Checkout Without Sacrificing SCA Compliance?

By Chinmay Jain on 21/03/2025

Strong Customer Authentication (SCA) regulations, introduced in January 2021 across the EU and enforced in the UK by March 2022, aim to secure online transactions. While necessary, additional authentication steps can create friction in the checkout process, leading to cart abandonment and dissatisfied customers.

This is where 3D Secure (3DS) Exemptions come into play. Designed as part of the 3DS 2.0 framework, these exemptions reduce unnecessary authentication steps for low-risk transactions. They create a smoother checkout process while maintaining compliance with SCA requirements.

By using the provision of 3DS 2.0 exemptions, merchants can reduce the times they are required to authenticate a cardholder, reducing friction and providing a seamless checkout experience and significantly reducing the customer abandonment rate.

New to 3D Secure? Start with our What is 3D Secure and How does it work? A complete guide for foundational insights.

What’s in the article:

-

What are 3D Exemptions?

-

How Can One Apply for 3D Secure Exemptions?

-

Types of 3D Exemptions

-

Top 4 Benefits of Using 3D Exemptions

-

Pros and Cons of 3DS Exemptions

-

Conclusion

-

Frequently Asked Questions About 3DS2 Exemptions

Contents

What Are 3D Exemptions?

Imagine this: A loyal customer is ready to purchase a €30 product from your site, but their excitement turns into frustration due to a one-time password or in-app validation request, which causes friction during the checkout process. They abandon the cart. Does this sound similar?

3D exemptions are part of the 3D Secure 2.2 (3DS2) framework, which is designed to optimize the payment experience while maintaining the highest security standards. These exemptions allow merchants to bypass Strong Customer Authentication (SCA) for low-risk transactions, allowing customers to check out the cart or pay the subscription fee with less friction or authentication steps, delivering a secure and smooth checkout experience.

Key Point: When a merchant successfully requests an exemption, the liability shift transfers fraud liability to the card issuer—but only if the issuer approves the request. If denied, SCA steps in automatically.

How Can One Apply for 3D Secure Exemptions?

Before applying for the 3D secure exemptions, one must understand who initiates the exemption and how liability shifts between parties. While you already know the 3DS exemption helps to reduce friction (authentication steps) and streamline payments, the application varies based on whether the merchant (acquirer) or the card issuer takes charge.

There are two primary methods of applying the exemptions:

1. Acquirer-Initiated Exemptions

Process: Merchants (via their payment acquirer) can request exemptions for transactions they deem low-risk. However, this approach comes with a critical trade-off: the merchant assumes full liability for fraud. If a transaction turns out to be fraudulent, the business bears the loss.

Risk: While this reduces checkout friction (no SCA prompts for customers), it’s a high-stakes gamble. Small businesses with tight margins might struggle to absorb fraud-related losses.

Best For: Businesses with a strong fraud detection system, consistent customers’ purchase journeys and low fraud risk goods.

2. Issuer-Initiated Exemptions

Process: The card holder’s bank (issuer) decides which transactions to exempt or not. The issuer bank bears the fraud liability, but in this case merchants lose control over the process.

Risk: Exemptions aren’t guaranteed, issuers use their risk criteria, which can cause delays during checkout.

Best For: Merchants prioritizing reduced liability over consistency.

3. Trusted Beneficiary Exemption

Process: Customers can add merchants to their “trusted list” via their banking portal. But the final decision is on the issuer to pass the transaction with SCA or apply the SCA during checkout.

Risk: Issuers can still enforce SCA for suspicious activity.

Best For: Recurring services (e.g., subscriptions) to boost customer retention.

Types of 3D Exemptions

Below are four common 3DS exemptions:

1. Low-Risk Transaction Exemption

Payment providers automatically bypass authentication for transactions deemed “low risk.” This decision is based on factors like the purchase amount, the merchant’s track record (e.g., low fraud rates), and the customer’s spending habits.Real-World Example: A cafe chain processing hundreds of $4 mobile orders daily might skip 3DS prompts. Their consistent low fraud history and small transaction sizes signal minimal risk to payment processors.

2. Trusted Beneficiary Exemption

Customers can flag frequently used merchants as “trusted” in their banking apps. Once approved, whenever a customer pays the bill or checks out the cart, they don’t have to submit the OTP or finger scan, which helps to make the transaction flow smooth and secure.Why It Matters: This builds loyalty by letting users streamline repeat purchases with brands they already trust.

Real-World Example: Imagine that you regularly buy groceries from the same home delivery site, you can add them as a trusted payee via your app so that when you look to checkout in future, you can avoid authentication.

3. Corporate Payments Exemption

B2B transactions, like bulk software licenses or vendor invoices—often use virtual cards or lodge cards. These payments are exempt from 3DS checks due to their predictable nature and pre-vetted business relationships. Businesses need efficiency for high-volume or recurring expenses. Exemptions prevent delays in critical payments.Real-World Example: A tech startup paying its $3,000 cloud hosting bill via a card payment can avoid authentication hurdles, ensuring timely service without interruptions.

4. Recurring Payments Exemption

Subscriptions or instalment plans (e.g., gym memberships, streaming services) only require authentication during the initial payment. And provides a seamless recurring billing experience without extra authentication.Why It Matters: Users dislike re-entering credentials for predictable, ongoing services. Exemptions reduce drop-offs in renewals.

Real-World Example: A fitness center charging a member’s card $60 monthly after an initial sign-up only needs SCA once on the initial transaction.

Top 4 Benefits of Using 3D Exemptions

-

Reduced Cart Abandonment: Fewer authentication steps while checkout leads to a smooth payment experience, and potentially reduces cart abandonment rates by up to 15%.

-

Lower Operational Costs: Fewer declines due to SCA friction, helps to reduce customer support costs.

-

Liability Shift Protection: Approved exemptions transfer fraud liability to issuers, which protects merchants from chargebacks.

-

Competitive Edge: A seamless checkout experience can differentiate your business from competitors and help businesses to build trust and loyalty with their customers.

Pros and Cons of 3DS Exemptions

Pros of 3DS Exemptions

-

Frictionless Checkouts: Skipping authentication steps (like OTPs) speeds up payments, helps businesses in improving users’ checkout experience. Happy customers = repeat buyers.

-

Boosted Retention: Seamless transactions experience keeps users loyal, especially for high-frequency merchants (e.g., coffee shops and business-based businesses).

-

Business Growth: Acquirers, issuers, and payment platforms benefit from higher transaction volumes and fewer abandoned carts.

Cons of 3DS Exemptions

-

Fraud Liability: If a merchant is applying the exemption, which we have explained earlier in the blog, will shift 100% of chargeback risk to the merchant. If a transaction is fraudulent, merchants have to bear the loss.

-

Regulatory Risk: Under EPC rules, if a fraudulent payment occurs without SCA and the customer isn’t at fault, the acquirer (merchant’s bank) is typically responsible for refunding the customer. This can result in financial losses for merchants, as the acquirer may seek to recover the funds from them.

-

Balancing Act: Exemptions work best for low-risk transactions, high-trust scenarios (e.g., repeat purchases). High-value or irregular transactions will still have to go through the Strong Customer Authentication (SCA).

Conclusion

3D Secure exemptions are a game-changer for businesses looking to provide seamless and secure checkout experience to customers. By using exemptions like low-risk transactions, trusted vendors, or subscription payments, companies can cut down on annoying authentication steps, keep more customers from abandoning their carts, and protect their sales—all while staying compliant. But to make this work, you need a clear grasp of where liability falls, a solid plan to prevent fraud, and the right tools to apply these exemptions smartly.

That’s where Celeris will help you. As your payment partner, Celeris offers advanced fraud detection and seamless 3DS2 integration, helping you automate exemptions, reduce checkout headaches, and pass liability to banks when possible. The result? Faster approvals, happier customers, and fewer lost sales.

Let's Connect

Just a few quick details. Our team will reach out to explore how our platform fits your payment stack and objectives.

Talk with one of our payment experts

Ready to elevate your business to new heights? Schedule a call with our experts to discuss your unique needs and uncover tailored solutions. Don’t let questions linger – seize the opportunity to pave your path to success!

Winner !

Best use of data analytics, MPE 2025

Best Payments Orchestration Solution, MPE 2024