Verifi specializes in dispute management, aiding sellers in revenue retention and cost reduction from banks.

- Resource

- /

- 6 Things you need to know about payment Integrations

Contents

Recommended Articles

What is Payment Orchestration? A Complete Guide for Businesses in 2026

December 9 2025 | Blog

A Payment orchestration is a software layer that connects your business to multiple payment service providers, acquirers, banks and other financial services through a single platform, it allows you to manage transactions across various partners and optimises success...

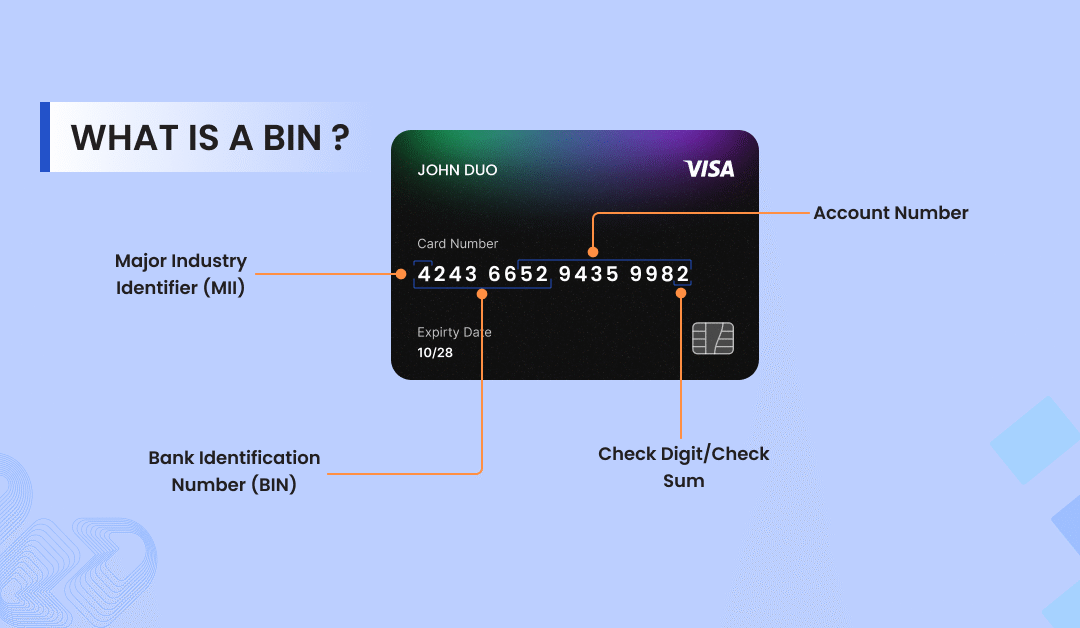

What is BIN in Card Payments? A Guide Every Merchant Need

November 26 2025 | Blog

Most businesses today close sales through conversations, not just via websites or apps. Customers interact with your brand across various channels, including Instagram, WhatsApp, email, and live chat.

Pay by Link: A Smarter Way to Accept Payments in 2025

July 31 2025 | Blog

Most businesses today close sales through conversations, not just via websites or apps. Customers interact with your brand across various channels, including Instagram, WhatsApp, email, and live chat.

Share This Post

6 Things you need to know about payment Integrations

By Abhishek Singh on 27/01/2021

Contents

Introduction

Since many participants are involved in online transactions, quality payment integrations are vital in setting up a successful payments strategy.

Chetan Chadha is leading the Integration Team at Celeris. His team is responsible for integrating with different merchants, acquirers, alternative payment methods, and other third-party solution providers.

The team is well revered and respected in the industry for carrying out payment integrations of the highest quality and speed.

We interviewed Chetan to give us more insight on this topic, and here is what he had to say:

1. Where does the need for integration come into play?

Chetan Chadha: It is necessary for a merchant’s website to be well integrated with an Acquirer/Gateway/PSP platform for effectively processing payments. To do this, it is first essential to understand how the processing of payment data is done. This includes knowing what data is needed from the merchant’s side, like their billing, shipping, and payment details and how the payment provider responds to it and processes it through the issuing bank. The merchant then needs to synchronize his/her platform with the payment provider for their integration to take place.

2. What are the various types of merchant integrations?

Chetan Chadha : Most payment providers use standard ways of payment integrations, which can be broken down into 5 types. Starting with Hosted Payment Page Integration which is when the merchant does not have their own payment page and hence needs to utilize the payment provider’s (third party’s) payment page for processing payments. Fortunately, the look and feel of the payment page can be customized to suit their website. This method is generally used by Merchants that are not PCI compliant.

As for Merchants that are PCI compliant they are integrated through a Direct/Server-to-Server approach and can have their own payment page. The payment data collected can then be passed onto the payment providers for processing.

In the case of Iframe/Modal view integration, a third party’s payment page is displayed on the merchant’s website by using a JS injector or third party wrappers.

While for mobile platforms like IOS/Android, payment providers offer to sync their SDK with the look and feel of the merchants’ mobile application. This is known as Mobile SDK Integration and is achieved with just a few lines of code.

Lastly, integration can take place using Payment Wrappers/Libraries. Most SMEs have their webstore on in-built shopping platforms/CRMs such as Zoomla, Drupal, WordPress, OpenCart, Woo-commerce, Magento, Prestashop, etc. In order to ease integration with these platforms, payment providers offer libraries for each platform.

3. How can one speed-up the process of integration?

Chetan Chadha: The fastest way for most merchants to integrate is to use the payment provider’s pre-built libraries/SDKs/Wrappers. These pre-built modules require only a few lines of code to start processing payments. Moreover, the choice of libraries/SDKs/Wrappers can be easily determined based on the programming languages compatible with the Merchant’s platform.

4. How do third-party libraries/SDK/Wrappers ease the process of integration?

Chetan Chadha: The third-party libraries/SDK/Wrappers ease integration in several different ways. They reduce the time of integration significantly and require no overhead for security protocols of the payment providers.

It is easy to upgrade to the latest versions using central/shared repositories, store previous versions (it’s compatible with backups), and get new features and patches.

Third-party libraries/SDK/Wrappers also allow one to identify the issues in the integration process that the payment providers can then debug.

Lastly, there is no need for high level development skills; the developer just has to follow a simple step by step documentation in order to integrate. As I had previously mentioned when talking about this type of integration, payment providers offer a wide range of options best suited for each individual programming language and platform

5. Why is it easier to integrate with Celeris?

Chetan Chadha: From the feedback we have received from our partners, I can outline a few reasons for why it is easier to integrate with us. At Celeris we support multiple programming languages and platforms while offering our partners a wide range of plugins, wrappers, SDKs, etc., that they feel are best suited for them. Working samples are also available for all of these programming languages. Our APIs are at par with the latest industry standards and our solutions are built on a plug-and-play architecture, making them easy to integrate. We believe in a unified approach to integration, which can take as little as 15 minutes. This is something our partners really value, as it allows them to go live within the same day. As our current partners will testify, we offer the fastest custom development and integration feature alongside an excellent integration support team to validate this.

6. What are the characteristics of good payment integrations?

Chetan Chadha: In my experience, I have realised a good integration must have an exceptional support team, requiring minimal manpower and resources. I also think it is important to have easy to follow documentation with standard API samples. The integration should take fewer steps and time to set up as well as to go live. However, this should not compromise on the security, which should be embedded on a minimum of three levels. Of course, it is also essential for the integration to be available in all the latest programming languages and platforms. Lastly, once the integration is done, it needs to be tested in different cases so that the client can verify and make sure that it stands up to their expectations and requirements.

Chetan’s Key elements of a premium integration

- Less number of steps

- Standard API approach

- Excellent integration support

- Three levels embedded security

- Less setup time and Time to go live

- Availability of latest platforms support

- Less manpower and resources requirements

- Easy to follow documentation with availability of API samples

- Availability of integration in all the latest programming languages

- Test-driven development approach -availability of different test suites

Let's Connect

Just a few quick details. Our team will reach out to explore how our platform fits your payment stack and objectives.

Talk with one of our payment experts

Ready to elevate your business to new heights? Schedule a call with our experts to discuss your unique needs and uncover tailored solutions. Don’t let questions linger – seize the opportunity to pave your path to success!

Winner !

Best use of data analytics, MPE 2025

Best Payments Orchestration Solution, MPE 2024