Considering the recently increasing shift from physical to online stores, customers are looking for ways that allow them to pay for their individual share when making a group purchase. In particular, when contributing towards gifts or group travel, the cost may be too hefty for any one individual to carry alone. Hence it’s essential for merchants to implement a way that allows dividing payments for a single transaction among multiple people. This is where our innovative solution comes into play- Split Payments; Going Dutch.

Challenges faced by merchants and customers with group purchases

Nowadays, customers expect an enhanced online experience with optimised payments and a user-friendly interface. From the merchants’ perspective, this might present a challenge when people buy in a group and would like to split their bill.With the increasing cost of day-to-day living, even small expenses such as groceries and gasoline can add up quickly. Hence, paying for friends or colleagues on top of running personal expenses could burn a hole in the customers’ pockets. Moreover, asking friends to pay back can be an awkward and sometimes even tiresome task, especially after several “gentle reminders” have not worked.

For this very reason, dropouts are common in industries that often involve group purchases, such as travel, groceries, restaurants, subscriptions, and concert/movie tickets. Especially during the holiday season with people buying gifts for their loved ones, going dutch has become a common practice.

After all, if one has to use another payment method such as a bank transfer to split a payment, this only adds an extra step to the process and hinders a seamless user experience.

Let us meet Mary, the head of payments for a new food delivery app. The app offers several deals and discounts on their website. Most of the promotions attract youngsters buying in larger quantities for their social gatherings or family dinners. As you can imagine, the website had many traction and inquiries for these coupon codes and offers. Despite this, Mary noticed that the conversion rates were unusually low. As she went through customer feedback forms, she soon realised that they were looking for ways to split their bill. Since her customer base mainly consisted of students on tight budgets, no one wanted to pay for the entire bill on their own. She needed to find a way that enabled multiple participants to complete the payment for the same transaction.

How do “Split Payments” benefit your business?

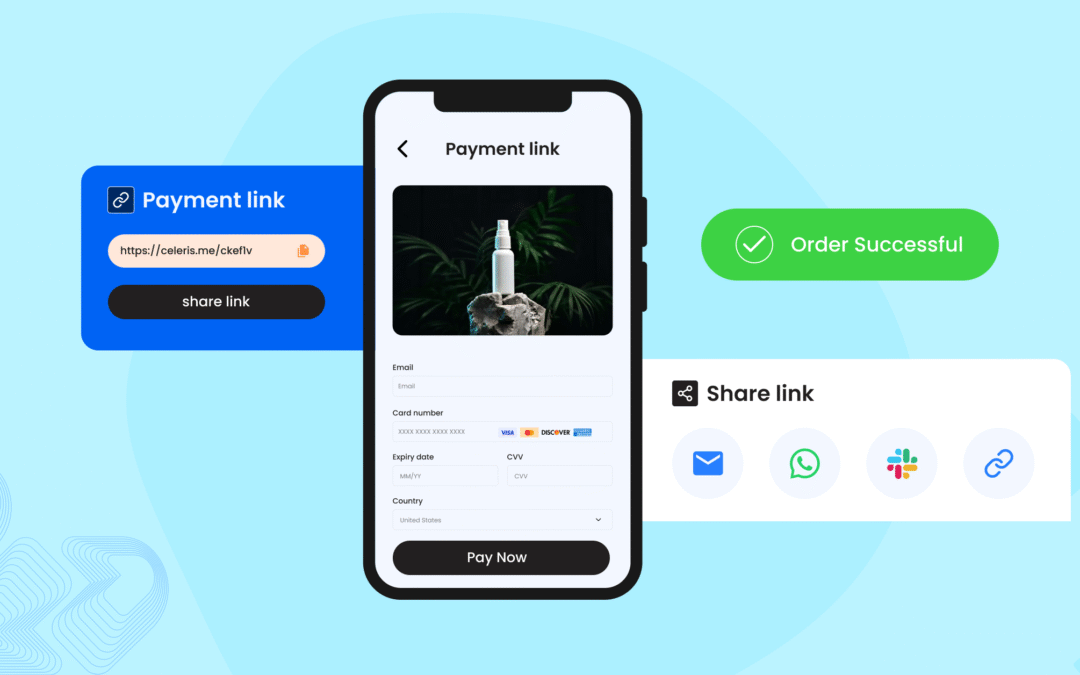

Many companies face a similar challenge to the one described above, and sometimes they are not even aware of the impact it can have. At Celeris, one of our most innovative features is the option of offering Split Payments; Going Dutch. An individual, ordering food online can easily choose friends, siblings, and colleagues to split the bill with. No more awkward conversations or asking for money, all they have to do is place the order for their group, add email addresses of the co-buyers and a link with the payment details will be sent to each requested member. The transaction is completed as soon as everyone finishes contributing to the entire bill amount. The applications of split payments are numerous; for example a group of travellers buying airline tickets, people contributing towards gifts for someone, roommates restocking their groceries together, and many more.

Pay bigger purchases with multiple cards or different payment methods

Split payments also allows customers the choice of paying with their preferred payment method like PayPal, credit cards, or even e-wallets. For instance, in the case of a customer not having enough balance in his e-wallet, the option of splitting the payment with his credit card is also available. Hence, Split payments are not limited to payments made in a group but can also be used by singular individuals. All in all, this feature significantly improves the user experience and subsequently boosts conversion rates.

Split Payments is easy to set up

At Celeris we offer all our merchants the option of split payments with a quick and easy integration. Online customers can look forward to more deals/discounts and subscriptions that they can avail themselves of with friends and family. Ultimately it helps online merchants promote their business and increase their customer base.

Interested to learn more about how Split Payments; Going Dutch and our other features can help you optimise your payments and increase your conversion rates? Reach out to us at [email protected]