Verifi specializes in dispute management, aiding sellers in revenue retention and cost reduction from banks.

Smart routing for seamless payment operations

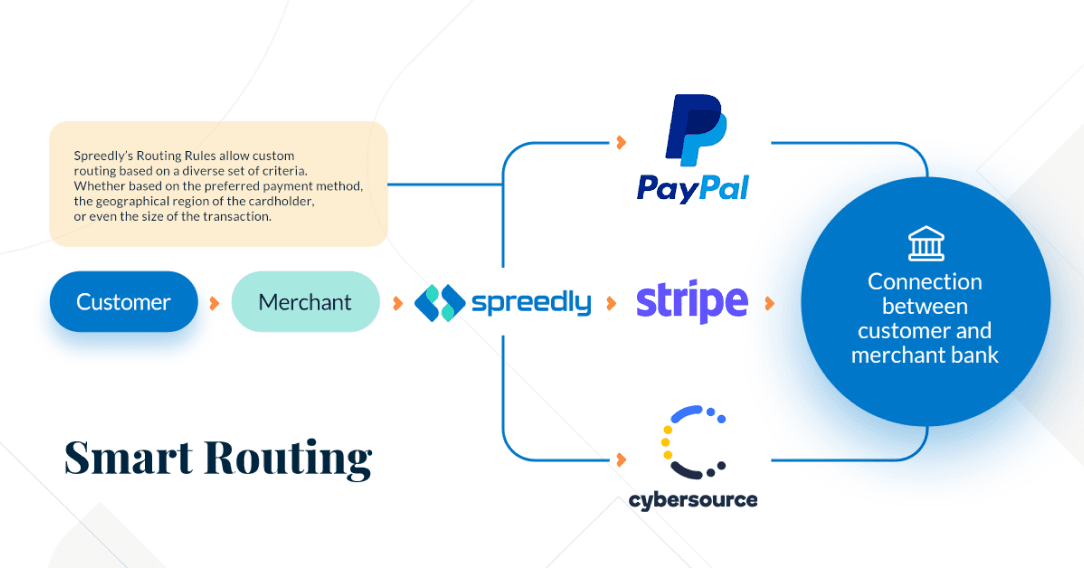

With Celeris’ Smart Routing & Cascading Payments, you can increase approvals, cut expenses, and provide a smooth payment experience. Make every transaction accepted to boost success rates and improve customer satisfaction.

One Integration . more opportunities . One Integration . more opportunities .

Here are some of the results our customers have achieved thanks to Smart Routing and Cascading. So can you!

In order to increase approval rates and decrease payment declines, cascading payments and retries automatically reroute unsuccessful transactions to alternate routes.

what is 3DS2

what is 3DS2

3DS2 is the way to comply with the SCA regulations. This requires merchants to build additional authentication into their payment flow,

using two out of the following three authentication elements.

passcodes

Something only the user knows .

gadgets

Something only the user knows .

biometrics

Something only the user knows .

Flex 3DS is a payments authentication solution that is implemented on a gateway level. Transactions are checked, taken into account exemptions, while supporting both traditional 3DS1 and 3DS2 versions

Compliance does not have to come at the cost of a seamless payment experience!.

Cuts expenses by circumventing 3DS acquirer fees & regular transaction fees for declined transactions.

Provides a frictionless checkout experience for customers.

Increases success rates while lowering the risk of fraud.

Ensures PSD2 compliance with a smooth 3DS2 flow.

One Integration . more opportunities . One Integration . more opportunities .

Automatically allocate a single transaction across partners, affiliates, or suppliers, simplifying settlement and ensuring transparency.

Define transaction-level fraud parameters using behavioural and regional data to lower false declines and protect revenue.

Offer returning customers a frictionless payment flow with one-click checkout, driving higher conversion and reduced abandonment.

Enable immediate settlement for merchants handling high transaction volumes, improving liquidity and operational cash flow.

Streamline recurring payments with a unified dashboard for upgrades, downgrades, renewals, and cancellations at scale.

Payment Routing: What It Is and

Payment Routing: What It Is and

Why It’s Important

Payment Routing: What It Is and Why It’s Important

Payment Routing: What It Is and Why It’s Important

Build your business with Celeris

Our gateway uses intelligent routing algorithms to direct transactions through multiple acquirers or banks, optimising for factors such as cost, approval rates, and geographic considerations.

Yes, our gateway allows you to customize routing rules. You can set preferences based on factors like transaction volume, currency, specific acquirer performance, and fallback options.

It uses an intelligent algorithm to direct the transactions to the acquirer which has a better chance of approval and has lower fees. Some factors that can influence are region, card type, and success rates.

By using the custom routing rules, you can choose the prior acquirer or payment methods that work better in specific regions.

Use failover routing to automatically reroute transactions to backup processors. The payment will continue and will reduce the impact of an interruption.

Yes. Celeris offers a real-time monitoring dashboard that you can track and examine success rates for different payment methods.

If a company has more than 1 acquirer, cascading payments can automatically reroute unsuccessful transactions to multiple processors, increasing approval rates.