Advantages and Disadvantages of White Label Payment Gateway

We have already discussed how white label payment gateways help businesses in payment processing but like any product, service or option white label payment solutions also have advantages and disadvantages.

Advantages

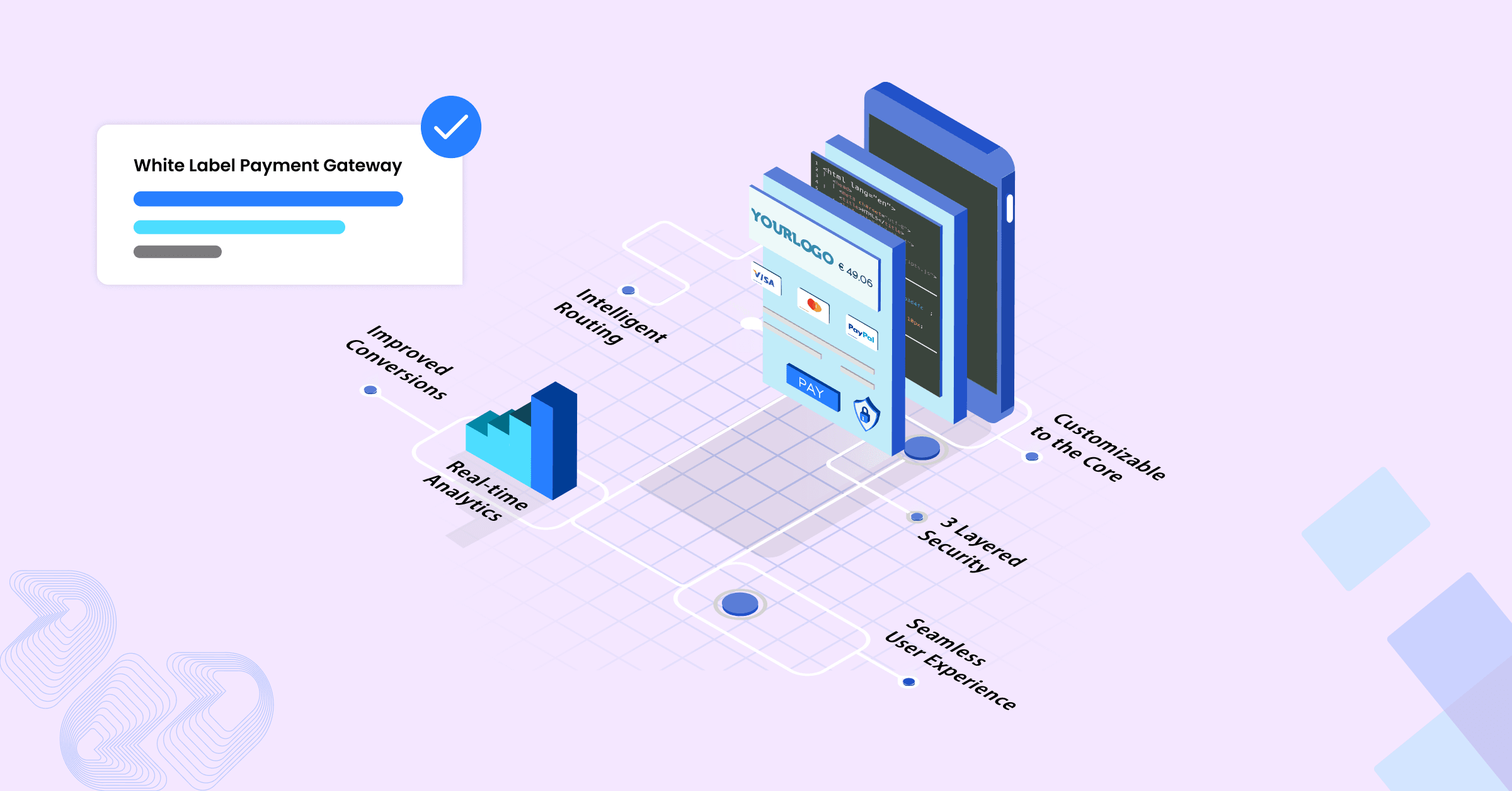

You can Launch Payment Gateway in Weeks: Building a payment processing solution in-house will take you at least a year and a half to obtain the necessary license, security, and compliance audits and software. And still, we have not added the time it takes to build a solid team, partner with financial institutes, and find the first client. With a white label payment gateway, you can go live in a month or less without wasting time in the most time-consuming process.

20 times less cost: You’re already aware of how much it costs you to build independent payment processing software. In many cases, the cost of product development costs you more than 20 times compared to ready-made white label payment solutions like (Celeris).

Required less Technical Knowledge: As we’ve mentioned already, how choosing a white label is more reliable than developing the solution in-house. With a good third-party provider like Celeris, we provide easy integration options like API, SDKs etc, a developer-friendly interface and technical support during integration and with all that you can go live in months and devote all your time and money to grow your business globally and Celeris will handle everything in backend.

Disadvantages

Choosing a white-label payment solution can be a game changer for your business but only when you’re choosing the right one otherwise you have to face the issues mentioned below:

Limited customisation option: Despite normal options like logo, color core functionalities might be restricted by the provider like changing text, elements, or features.

Dependency on provider: You need to rely on the provider for updates, maintenance and uptime.

Compliance responsibility: Before choosing the provider must check if they have global and local compliance.

Costs accumulate over time: While some providers may charge you less as an initial setup cost they might charge you a higher transaction fee later on while scaling your business which is a burden.

How Celeris Addresses These Disadvantages

Celeris get over these challenges with fully customisable and scalable solutions tailored to your business needs. Our platform allows you to make advanced customisations, ensures reliable performance, and simplifies compliance, all while providing cost-effective options that grow with your business.