This month marked the one-year anniversary of coronavirus lockdowns in most European countries. Since then, we had to change the way we interact, work and even pay. As a payments company, the latter is a especially interesting topic for us to address. Therefore, in this blog, we will take a look at how the coronavirus impacted peoples’ payment habits and whether these changes are long-lasting. Namely, with the pandemic’s end in sight, one needs to consider which consumer preferences and payment trends are here to stay and will become part of the new normal.

Omni-channel Payments

The pandemic shifted customers from offline to online and so businesses had to expand their customer touch-points beyond the traditional face-to-face. Although it has always been the case that some customers preferred to shop in-store, some on their smartphones, while others on a laptop – the pandemic underscored these customer demands. Thus, in order to cater to all customers, businesses need to adopt an omni-channel approach to commerce, allowing customers to shop and pay the way they want.

A noteworthy trend to mention in regards to omni-channel payments is contactless payments, which are enabled through NFC technology. During the past year, the popularity of contactless payments increased substantially as naturally people avoided touching surfaces. This greatly accelerated the adoption of contactless payments with the Mastercard survey showing that 74% of people will continue using contactless after the pandemic is over. Accordingly, it is clear that this payment trend is going to stay relevant in the future.

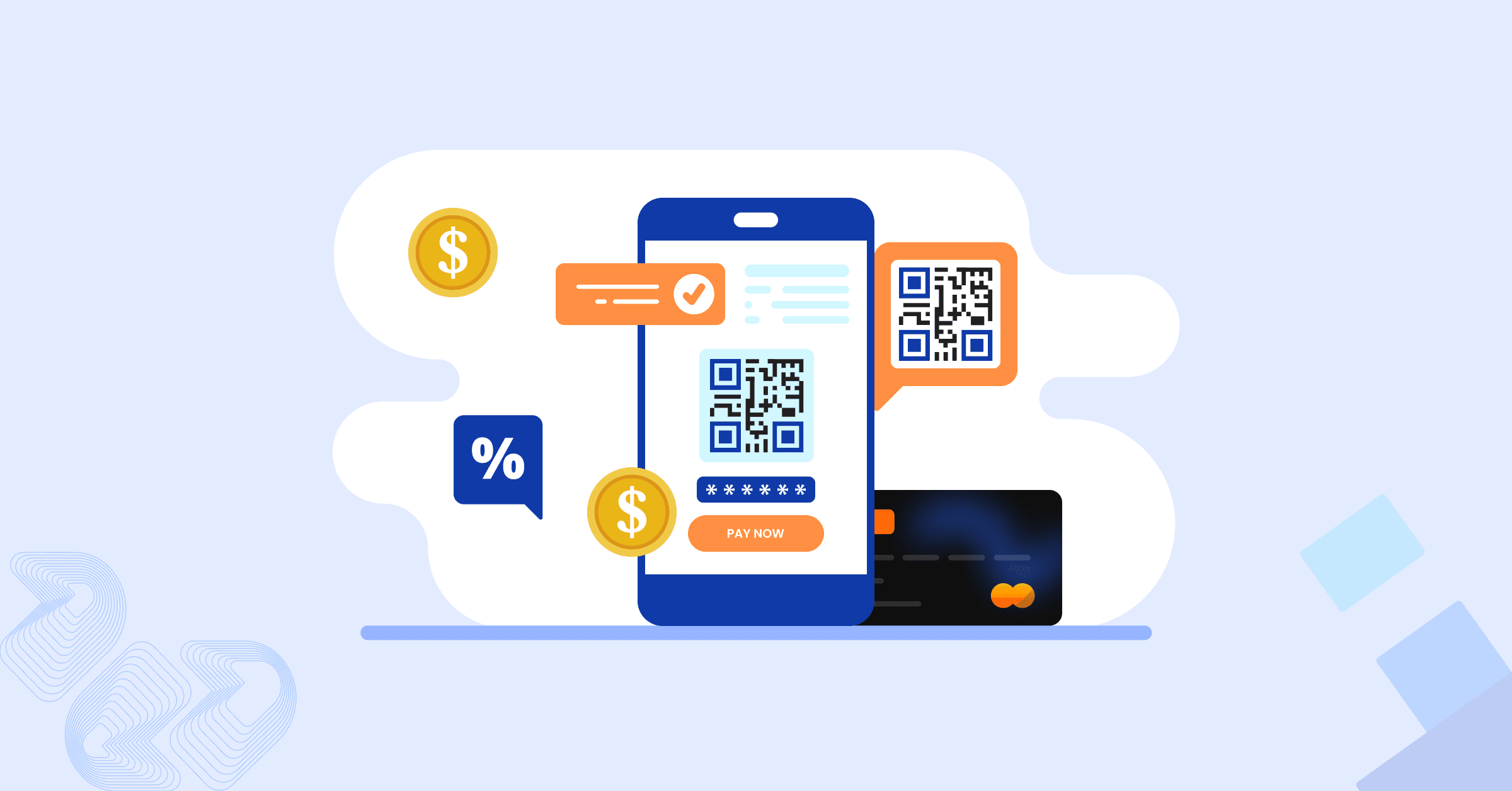

QR Code Payments

One of the most popular payment trends enabling omni-channel commerce is QR code payments. According to Juniper Research, QR code payments will become the most used online payment method during the next 5 years, accounting for 27% of all digital commerce transactions in 2024. Moreover, the popularity of QR payments has significantly increased since the start of the pandemic – seeing an 11% boost of new users in the US. Considering how fast, easy and secure QR payments are, there is little doubt that this method will continue to remain important in the payments landscape.

Social media payments

As most consumers spent the majority of their time at home during this past year, social media became an important source of entertainment. Thus, as the usage of social media increased, so did the opportunities for e-commerce merchants to tap-into selling on social networks. As a result, shoppers have become more comfortable shopping on social media platforms, with one Mastercard study revealing that 43% of Brits shopped more through social media in the past year. The same study also reports that efficiency and ease of purchase are the main reasons driving the adoption of social media shopping. In fact 28% of Brits state that they choose social media shopping, because they can pay “at the click of a button”. Hence, it is apparent that social media payments are an important aspect of social platform commerce and will likely remain important even after the pandemic, as the usage of social media is certainly not disappearing any time soon.

Conclusion

Clearly, 2020 has been a year full of changes,this was certainly the case for online payments as well. As discussed in this blog, we saw four new payment trends emerge as most customers transitioned to a new way of paying; omni-channel, QR Code, mobile and social media payments. Overall, the common themes seen here are convenience and simplicity, which is why we believe that these payment trends will remain popular in our post-pandemic lives. Therefore, it might be useful to consider these trends in your business’ payments strategy, as the Covid-19 pandemic has surely changed the customers’ payment habits for good.