Paysafe Limited is a multinational online payments company providing businesses with payment processing and digital wallets.

- Resource

- /

- Payment Orchestration is more than just Transaction Routing

Contents

Recommended Articles

Improve Subscription Success Rates by Tackling Outdated Card Info: A Guide for Businesses

November 19 2024 | Blog

Introduction The subscription-driven economy is booming, seamless payment processing is the lifeblood of businesses offering recurring services and subscription-based payment options. Whether it's a monthly streaming service, a subscription box, or monthly repayment...

Celebrating Celeris’ Recognition in POSitivity Magasine for Winning the MPE Award

July 11 2024 | Blog

Celebrating Celeris' Recognition in POSitivity Magazine for Winning the MPE AwardWe are excited to share that Celeris has been featured in the latest issue of POSitivity Magazine. This coverage celebrates our win of the prestigious MPE Award for Best Payments...

Unveiling the Power of Omission Reporting in Online Payment Management

May 23 2024 | Blog

Introduction In the ever-evolving landscape of online transactions, an unyielding commitment to precision and oversight is paramount for the financial departments and the individuals responsible for online payments with e-commerce merchants. Faced with the intricate...

Share This Post

Payment Orchestration is more than just Transaction Routing

May 17, 2023

As online payments become increasingly important to businesses worldwide, it is essential to have a reliable and efficient payment gateway that can handle multiple payment methods, currencies, and jurisdictions. This is where Payment Orchestration comes into play. Payment Orchestration is a solution that enables businesses to manage their online payments more effectively and efficiently.

Contents

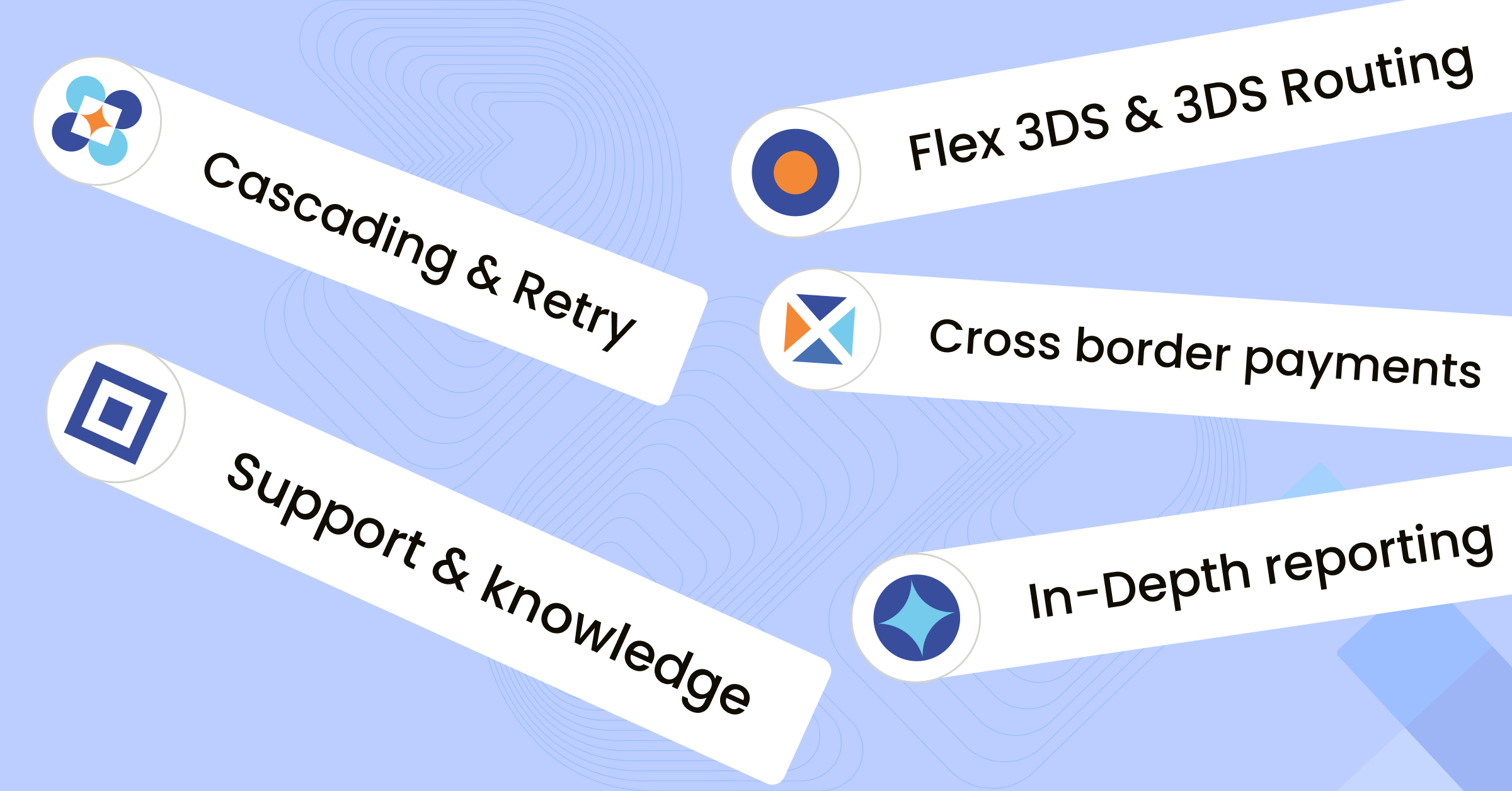

An Orchestra is not only the Piano

So, what is Payment Orchestration, and how does it work? Imagine an orchestra – each musician plays a specific instrument, and each instrument produces a unique sound. The piano is part of the orchestra, but it does not comprise the whole orchestra. When all musicians play together, the resulting sound is beautiful and harmonious. Payment Orchestration is similar to a symphony orchestra. Transaction routing is not Payment Orchestration; it is just one part of Payment Orchestration. Together with all the other important features of Payment Orchestration, it provides a seamless and efficient payment experience for businesses and their customers. A real payment orchestra performance!

Each merchant is like a unique symphony

Every merchant has their specific demands, wishes, challenges, accents and priorities. Just like an orchestra needs to understand the symphony and the way it should be played, the payment orchestration platform needs to get to know the merchant to make sure all the features are finely tuned to get the best results. We discuss the elements that make or break a great orchestration below.

High costs because of chargebacks and fraud

One of the main problems that Payment Orchestration solves is high chargeback and fraud costs. A chargeback occurs when a customer disputes a transaction, and the merchant is required to refund the payment or challenge the chargeback. Chargebacks can be expensive for merchants as they often result in lost revenue, additional fees, and reputational damage. Fraud is another issue that can be (very) costly for merchants. Fraudulent transactions can result in financial losses, chargebacks, and reputational damage. Payment Orchestration should help reduce chargebacks and fraud by providing fraud prevention tools and real-time transaction monitoring.

How do I know what to do without the relevant data?

Another problem that Payment Orchestration solves is the lack of insight into merchants’ transaction data. Many merchants struggle to gain visibility into their transaction data, which can make it challenging to identify trends, optimise payment flows, and manage chargebacks. Payment Orchestration provides merchants with real-time transaction data, which they can use to benchmark and gain insights into their customers’ behaviour, payment preferences, and transaction patterns.

How to increase my success rate?

Payment Orchestration can also help merchants fix low success rates and high costs. Low success rates occur when transactions fail to go through, either due to technical issues or declines from the customer’s bank. High costs can result from multiple factors, such as high processing fees, chargebacks, and refunds. Intelligent Transaction Routing can help merchants improve their success rates and reduce costs by providing access to multiple payment methods, acquirers, and PSPs. Rule setting enables merchants to choose the best payment method for each transaction, based on factors such as location, currency, customer preferences, and many more.

Summary Part 1

One of the elements we discussed in this blog is fraud prevention and chargeback reduction. We also explored how Payment Orchestration provides valuable transaction data insights to merchants and how it can improve success rates while reducing costs through intelligent transaction routing and rule-setting. Join us for Part 2 of this series to learn more about the essential features of Payment Orchestration and how they can benefit your business.

If you have any questions about payment orchestration, payments strategies or white-label platform solutions? Reach out to us; we will gladly help you find the answers. Fill out the form below, and we will contact you shortly. Or drop us an email at info@celerispay.com.

Related Resource

Related Resource

Share This Post

Build your business with Celeris