Verifi specializes in dispute management, aiding sellers in revenue retention and cost reduction from banks.

- Resource

- /

- How Different Demographics Use Google Pay & Apple Pay

Contents

Recommended Articles

What is Payment Orchestration? A Complete Guide for Businesses in 2026

December 9 2025 | Blog

A Payment orchestration is a software layer that connects your business to multiple payment service providers, acquirers, banks and other financial services through a single platform, it allows you to manage transactions across various partners and optimises success...

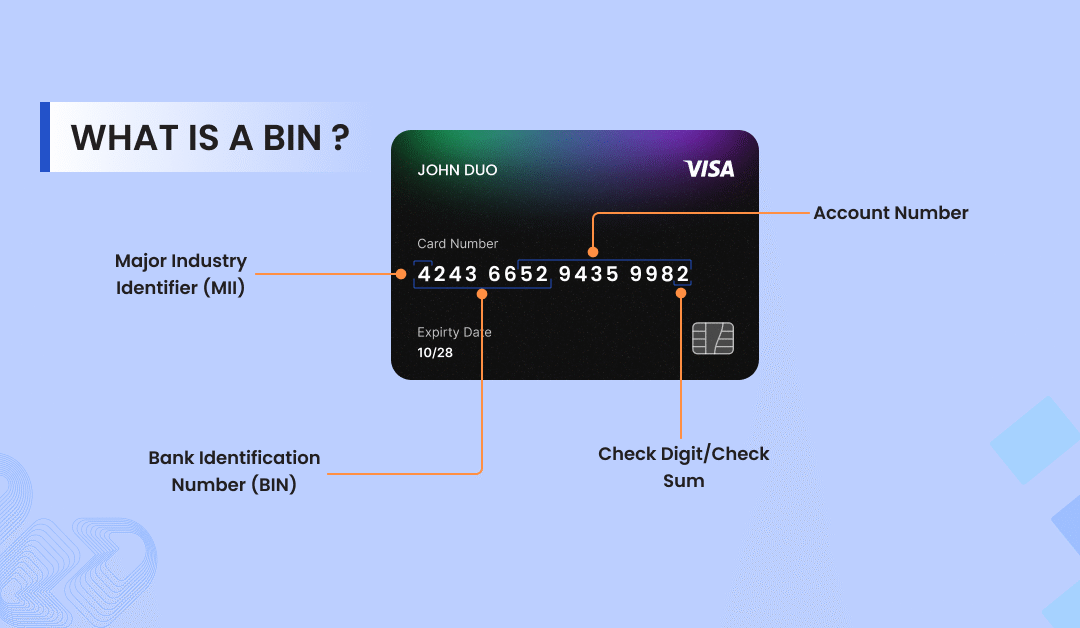

What is BIN in Card Payments? A Guide Every Merchant Need

November 26 2025 | Blog

Most businesses today close sales through conversations, not just via websites or apps. Customers interact with your brand across various channels, including Instagram, WhatsApp, email, and live chat.

Pay by Link: A Smarter Way to Accept Payments in 2025

July 31 2025 | Blog

Most businesses today close sales through conversations, not just via websites or apps. Customers interact with your brand across various channels, including Instagram, WhatsApp, email, and live chat.

Share This Post

How Different Demographics Use Google Pay & Apple Pay

By Chetan Chadha on 28/02/2025

Mobile wallets like Google Pay and Apple Pay are becoming essential to global transactions as digital payments continue to advance. However, due to characteristics like age, location, financial level, and experience with technology, their adoption and usage vary considerably among different groups. Understanding these variations can help businesses optimise payment strategies and improve customer experiences.

Contents

Gen Z (18-24 years old): The Digital Natives

Gen Z has become accustomed to mobile wallets because they were raised in the digital age. Their inclination for digital payments is driven by convenience, quickness, and security. Many Gen Z customers make daily purchases using mobile wallets, especially for subscriptions, online shopping, and food delivery.

-

Preferred Use Cases: Peer-to-peer (P2P) transfers, app-based applications, and online purchasing.

Key Features They Value: Biometric authentication, one-tap checkout, and loyalty program integration.

Challenges: Due to their continued financial dependence on their parents, some Gen Z users may only be able to make small purchases using these wallets.

Millennials (25-40 years old): The Power Users

Among the most frequent consumers of digital payments are millennials, who were among the first to accept them. Whether they share bills, purchase online, or make in-store purchases, they value how easy it is to use Google Pay and Apple Pay.

Preferred Use Cases: In-app purchases, bookings for travel, meals, and regular payments (bills, subscriptions).

Key Features They Value: Budgeting tools, cashback and rewards, and contactless transactions.

Challenges: Despite their high level of engagement, some millennials still think about security and data privacy risks before fully committing to mobile wallets.

Gen X (41-56 years old): The Cautious Adopters

Despite being more hesitant to embrace new payment technology, Gen X users have adopted mobile wallets due to their security and ease. Apple Pay and Google Pay are frequently used with more conventional payment methods like credit cards and online banking.

Preferred Use Cases: Groceries, retail shopping, utility bill payments.

Key Features They Value: Security features, including fraud prevention, tokenisation, and smooth banking app interaction.

Challenges: Some Gen X users still prefer physical cards since they feel more in control of conventional payment methods.

Baby Boomers (57-75 years old): The Skeptical Users

For the most part, Baby Boomers have been slower in embracing digital payments because they still prefer cash, checks, and conventional credit cards. However, as smartphones become more widely used and knowledge grows, many Boomers are using mobile wallets, mainly for convenience and security reasons.

-

Preferred Use Cases: pharmacies, large retail establishments, and occasionally online shopping.

-

Key Features They Value: Fraud prevention, ease of use, and transparent customer support.

Challenges: Aversion to switching from traditional banking systems, security concerns, and unfamiliarity with mobile wallets.

High-Income vs. Low-Income Users

Income levels also play a significant role in how people use mobile wallets.

High-Income Users: Apple Pay is more likely to be used due to its integration with premium Apple products. They prefer mobile wallets for convenience, travel, and premium experiences such as VIP services and luxury shopping.

Low-Income Users: Often rely on Google Pay due to its accessibility across various Android devices. Many use it for everyday expenses, remittances, and discounts on essential goods.

Urban vs. Rural Users

The urban-rural divide impacts digital wallet adoption:

Urban Consumers: More frequent users, given the widespread availability of contactless payment terminals, e-commerce, and app-based services.

Rural Consumers: Adoption is slower due to limited access to reliable internet, fewer digital payment options, and a more substantial reliance on cash-based transactions.

Global Adoption Trends

Adoption rates of Google Pay and Apple Pay vary by region:

-

North America & Europe: High adoption rates due to widespread NFC infrastructure and digital banking penetration.

-

Asia-Pacific: Rapid growth, particularly in India, China, and Southeast Asia, where mobile wallets are becoming dominant.

-

Latin America & Africa: Slower adoption but growing due to increased smartphone penetration and financial inclusion initiatives.

Conclusion

To optimise payment strategies, merchants must recognise how different demographics use Google Pay and Apple Pay, influenced by factors like age, income, location, and tech familiarity. Tailor your offerings to address the unique needs of each group, prioritising seamless, secure, and accessible transactions. As mobile wallet adoption surges, leveraging insights into these demographic trends will be crucial for boosting customer satisfaction and driving business growth. Act now by analysing your customer data and aligning your payment solutions accordingly to capture this growing market effectively.

Let's Connect

Just a few quick details. Our team will reach out to explore how our platform fits your payment stack and objectives.

Talk with one of our payment experts

Ready to elevate your business to new heights? Schedule a call with our experts to discuss your unique needs and uncover tailored solutions. Don’t let questions linger – seize the opportunity to pave your path to success!

Winner !

Best use of data analytics, MPE 2025

Best Payments Orchestration Solution, MPE 2024