Verifi specializes in dispute management, aiding sellers in revenue retention and cost reduction from banks.

- Resource

- /

- How to Choose Best Chargeback Management Solution in 2025?

Contents

Recommended Articles

What is Payment Orchestration? A Complete Guide for Businesses in 2026

December 9 2025 | Blog

A Payment orchestration is a software layer that connects your business to multiple payment service providers, acquirers, banks and other financial services through a single platform, it allows you to manage transactions across various partners and optimises success...

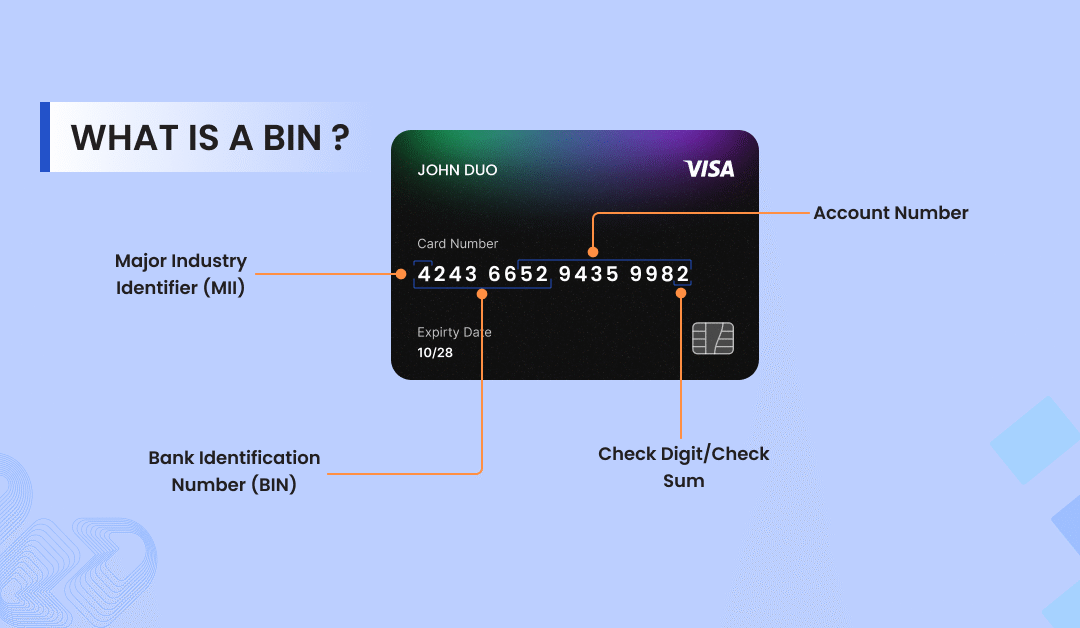

What is BIN in Card Payments? A Guide Every Merchant Need

November 26 2025 | Blog

Most businesses today close sales through conversations, not just via websites or apps. Customers interact with your brand across various channels, including Instagram, WhatsApp, email, and live chat.

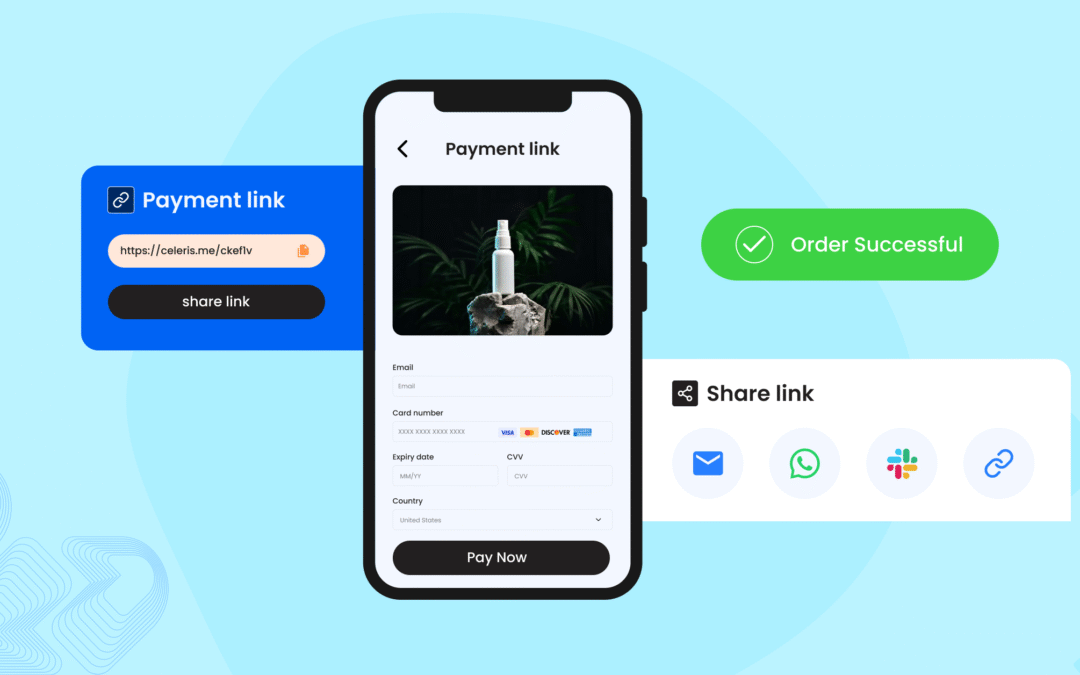

Pay by Link: A Smarter Way to Accept Payments in 2025

July 31 2025 | Blog

Most businesses today close sales through conversations, not just via websites or apps. Customers interact with your brand across various channels, including Instagram, WhatsApp, email, and live chat.

Share This Post

How to Choose Best Chargeback Management Solution in 2025?

By Chinmay Jain on 07/05/2025

Chargebacks are a growing concern for online businesses today. A market research report published on Paypers reported that merchants lose 1% of their revenue in chargebacks every year, and this number is increasing, regardless of whether you’re in e-commerce, subscriptions, gaming, or digital services. Beyond lost revenue, chargebacks can lead to increased operational costs and long-term damage to your reputation.

To stay ahead in the markets, you need more than manual processes and responses. A good chargeback management solution can help you prevent chargebacks, provide instant alerts, manage chargeback disputes, and provide complete evidence to fight disputes and recover lost revenue.

In this guide, we’ll explore everything you need to know before choosing the best chargeback solution for your business. We’ve covered everything from what chargebacks are, their impact, proven strategies for preventing chargebacks, and why the Celeris chargeback solution can be a perfect fit for your business needs.

Contents

Understanding Chargebacks

Before diving into the main topics, let’s first understand what chargebacks are, the chargeback process, and the main reasons customers initiate them.

What Is a Chargeback?

A chargeback occurs when a customer disputes a transaction and their bank reverses the transaction. Chargebacks are designed to protect buyers from fraud. But nowadays it often hurts honest merchants due to reasons such as:

-

Unrecognised or forgotten transactions

-

Product not received or not as described

-

Duplicate billing or unclear return policies

-

Fraudulent activity on the customer’s card

Example: A customer subscribed to your subscription services but forgot they had a monthly service the next month and disputed the charge, even though they had opted in.

What Is the Chargeback Process?

The standard chargeback process involves the following stages:

-

Initiation by the cardholder through their issuing bank.

-

Notification sent to the payment processor.

-

Representment where the merchant needs to provide evidence to dispute the claim.

-

Resolution where the issuer accepts or denies the merchant’s evidence and rules either for or against the chargeback.

Understanding this process is key to fighting chargebacks effectively.

What Are the Common Reasons for Chargebacks?

-

Fraudulent Transactions (e.g., stolen card misuse).

-

Friendly Fraud (false claims about non-delivery).

-

Merchant Errors (e.g., duplicate charges, unclear policies).

-

Product Not as Described (dissatisfaction with quality).

Step-by-Step Guide for Effective Chargeback Prevention and Detection Strategies

Why Your Business Needs Payment Orchestration

Choose Smart Chargeback Management Solution

You can’t prevent what you can’t see coming. That’s why the first step is choosing a chargeback platform offering detection and prevention features. Celeris integrates with Ethoca and other chargeback alert tools to provide real-time dispute notifications. These early alerts give businesses a critical window to refund, resolve, and respond quickly, allowing them to act before disputes escalate into full chargebacks.

Use Clear Return and Refund Policies

One of the most common causes of chargebacks is confusing or missing return and refund policies on your website or store. If a customer isn’t sure how to return, refund, or cancel the subscription, they’ll often go straight to the bank for refunds and raise disputes.

Here is what businesses can do:

-

Display policies at product or checkout pages.

-

Keep the language simple and easy.

-

Include return or refund info in confirmation emails.

-

Respond to refund enquiries promptly.

For example, Amazon displays its refund policies on every product page to reduce confusion after a purchase.

Use Fraud Prevention and Customer Authentication Tools

Many chargebacks happen because of fraud, especially when the card isn’t physically used—like in online shopping. Signs like strange email addresses, odd names, or several failed payment attempts can be warning signs. That’s why it’s important to use tools that help spot fraud and confirm the buyer’s identity before completing the payment.

What we recommend:

-

Use 3D Secure authentication (Visa Secure, Mastercard Identity Check).

-

OTP or biometric login for apps or logged-in purchases.

These steps not only help reduce chargebacks but also boost your legitimacy in the eyes of payment processors as well as customers.

Maintain Strong Transaction Records

Having all the necessary proof can be the difference between winning and losing disputes. Our advanced solution stores all the information in the dashboard including, transaction history, proof of 3DS etc.

Track Your Chargeback Ratio

Your chargeback ratio matters more than you think. All payment processors monitor it closely, and crossing the threshold (usually 0.9% of transactions or more) can result in a penalty or even account termination.

What to track:

-

Monthly chargeback rate (% of total transactions)

-

Trends by product, region, or payment method.

-

Repeat customer disputes.

Celeris provides a live dashboard for all of this, so our users can stay compliant and spot trends before they become problems.

What Are the Benefits of Using a Chargeback Management Tool?

Handling chargebacks on your own can be time-consuming and effort-intensive, and mistakes can be costly. That’s why you need chargeback management tools to make the process easier and more effective.

Here’s how chargeback management tools can help:

-

Fraud Detection and Prevention: A right chargeback solution like ours we provide strong fraud detection and prevention tools in build, like 3DS authentication for detecting fraud transactions and prevention features like blocking the card for future fraud prevention.

-

Save time with automation: Instead of manually gathering documents and responding to every dispute, the chargeback tool will do it for you, faster and with fewer errors.

-

Understand what’s going on: You’ll get complete analytics reports that show why chargebacks are happening so that you can analyse and make data-driven decisions to prevent chargebacks in future.

-

Get early warnings: Our chargeback solution is integrated with Ethoca and Verifi, which provides early alerts when there’s a potential problem, giving your team a window to refund, resolve, or respond to disputes before they become chargebacks.

Celeris’ advanced chargeback solution provides all of this together in one platform, helping online businesses reduce chargebacks, protect their revenue, and focus on growth instead of fighting disputes.

What to look for in a Chargeback solution?

- Must-Have Feature

- Real-time Fraud Detection

- Automation Capabilities

- Dispute Management Tools

- Analytics & Reporting

- Seamless Integration

- Why It Matters

- Stops issues before they escalate

- Saves time and eliminates manual errors

- Helps win legitimate claims

- Uncovers trends to improve operations

- Works with your existing payment systems

Final Words on Chargeback Management Solution

Chargebacks are not only a revenue loss it’s a threat to your business’s reputation and sustainability. But with an active approach and the right chargeback management tool, you can reduce disputes, win more claims, and protect your bottom line.

Celeris equips businesses with innovative fraud prevention, fast resolution, and the insights you need to stay in control.

Let's Connect

Just a few quick details. Our team will reach out to explore how our platform fits your payment stack and objectives.

Talk with one of our payment experts

Ready to elevate your business to new heights? Schedule a call with our experts to discuss your unique needs and uncover tailored solutions. Don’t let questions linger – seize the opportunity to pave your path to success!

Winner !

Best use of data analytics, MPE 2025

Best Payments Orchestration Solution, MPE 2024