Verifi specializes in dispute management, aiding sellers in revenue retention and cost reduction from banks.

- Resource

- /

- Difference between a payment gateway and payment processor

Contents

Recommended Articles

What is Payment Orchestration? A Complete Guide for Businesses in 2026

December 9 2025 | Blog

A Payment orchestration is a software layer that connects your business to multiple payment service providers, acquirers, banks and other financial services through a single platform, it allows you to manage transactions across various partners and optimises success...

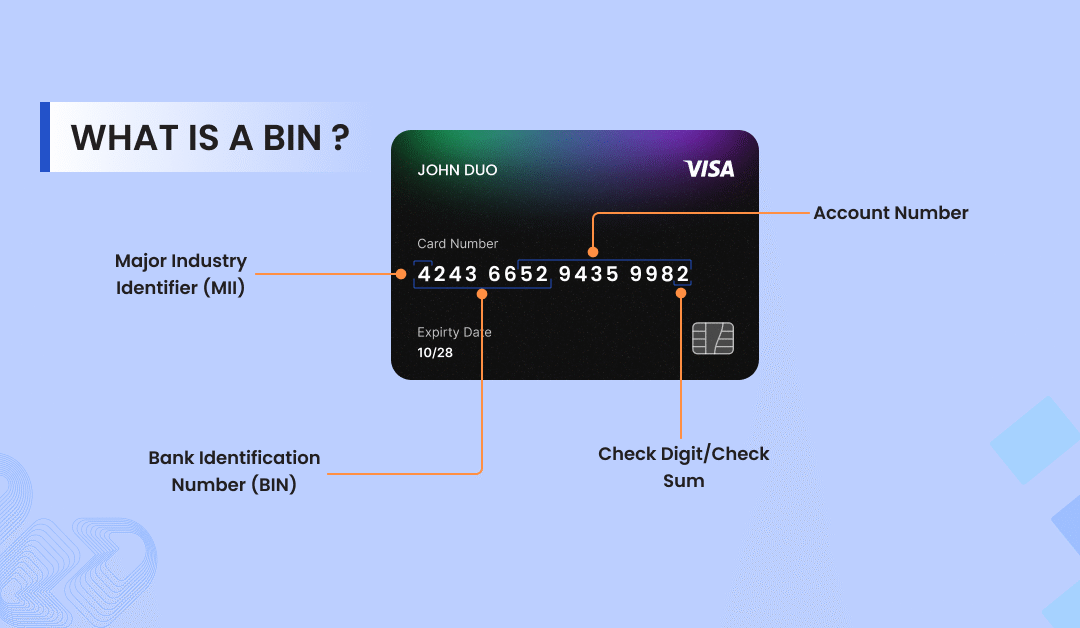

What is BIN in Card Payments? A Guide Every Merchant Need

November 26 2025 | Blog

Most businesses today close sales through conversations, not just via websites or apps. Customers interact with your brand across various channels, including Instagram, WhatsApp, email, and live chat.

Pay by Link: A Smarter Way to Accept Payments in 2025

July 31 2025 | Blog

Most businesses today close sales through conversations, not just via websites or apps. Customers interact with your brand across various channels, including Instagram, WhatsApp, email, and live chat.

Share This Post

Difference between a payment gateway and payment processor

By Chinmay Jain on 24/08/2021

Understanding the role of a payment gateway versus a payment processor is crucial for any business offering services online, whether running an e-commerce store or part of the fintech industry and handling online transactions. Two terms you’ll often encounter in this process are “Payment Gateway” and “Payment Processor”. While they both have crucial roles in online transactions, their functions are quite different.

You need to understand the concept of online payment and how that can streamline your operations and safeguard sensitive customer data. In today’s growing digital commerce, you need to offer seamless and secure payment options to every customer.

This blog will break down everything you need to know about payment gateways and processors, making it easier for you to understand.

What is the key difference between them, and why are both essential for online transactions?

Contents

What is a Payment Gateway?

Before understanding the difference, you need to understand what a payment gateway is and how it works. A payment gateway is like a virtual point of sale (POS) terminal for online transactions. Think of it as a bridge between your website or app and the payment processor.

Key Functions of a Payment Gateway:

A payment gateway performs the initial steps of a transaction:

-

Data Capture: The payment gateway collects the customer’s payment data, such as card details, and encrypts it for security.

-

Data Transfer: It securely transmits the payment details to the payment processor (Bank) for further verification.

-

Transaction Status Updates: Once a transaction is authorised, the merchant and customer are notified about whether the transaction was successful or declined.

-

Seamless Integration: Most modern payment gateways, like Celeris, integrate easily with your website app or e-commerce platform. We offer multiple integration options, such as pre-built APIs, E-commerce Plugins, etc. We also offer various payment options, multi-currencies, and personalised checkout pages for a seamless and secure payment experience

What is a Payment Processor?

Now we know that the payment gateway works as a front end, focusing on encrypting the payment data, and the payment processor works behind the scenes. It handles the actual data transfer between the customer’s bank (issuing bank) and the merchant’s (acquiring bank).

Key Functions of a Payment Processor

-

Data Transit (settlement): A payment processor securely transfers the payment data between a merchant, issuing bank, and acquiring bank.

-

Transaction Completion: It securely transmits the payment details to the payment processor (Bank) for further verification.

-

Transaction Status Updates: The payment processor ensures the fund is deducted from the customer’s bank and deposited into the merchant’s bank account.

-

Hardware and Physical Payments: Some payment processors provide card readers and POS systems for in-store payments.

Payment Gateway vs Payment Processor: Key Differences

As we discussed earlier, what do payment gateways and processors do? Now, let’s compare the differences with the comparison table to better understand.

| Featured | Payment Gateway | Payment Processor |

| Primary Function | Captures and encrypts payment details | Routes and facilitates payment transactions |

| Role in Transactions | Handles front-end operations | Handles back-end operations (fund movement) |

| Scope | Focused on card-not-present | Supports both online and offline payment |

| Communication | Sends data to the payment processor for authorisation | Interfaces with banks to settle transactions |

Both are crucial for businesses operating in the digital world (E-commerce, subscription-based businesses, PSPs, etc.) and accepting payments online. A payment gateway helps merchants create seamless and secure transactions, whereas a payment processor helps to complete the transactions.

How Do Payment Gateway and Payment Processors Work Together?

Here’s how these two components collaborate to complete an online transaction:

-

A customer clicks “Pay Now” on your website and enters their payment details, such as their credit card number or wallet.

-

The payment gateway collects, encrypts, and securely transfers this data to the payment processor.

-

The payment processor will forward the transaction request to the issuing bank for fund authorisation (Availability of funds).

-

The processor will notify the gateway once the issuing bank approves or declines the transaction.

-

The payment gateway relays this status to your store and your customer.

-

If the transaction is approved by the issuing bank, the payment processor ensures the funds are transferred to a merchant account.

Now you understand both systems are critical—one ensures a seamless customer experience, while the other ensures the transaction is secure and completed.

Security Measures in Payment Processing

According to research conducted and published on Juniper Research in 2022, Online payment fraud will exceed $343 billion by 2027, with these growing concerns about payment fraud merchants need to prioritise security in their payment system.

This is where payment gateways and processing combine forces to protect sensitive customer data through:

SSL Certificates

This technology encrypts the website’s connection with the customer’s browser, ensuring sensitive payment details are transmitted securely. If your website URL starts with “https,” you already have an SSL certificate.

Payment Tokenisation

To understand, let’s assume you’re buying a product from an e-commerce store and you click “pay now” and enter the card details. Tokenization will replace your credit card number with randomly generated characters during the transaction. This significantly reduces the risk of data breaches, as actual card data is never stored or transmitted.

Fraud Prevention Systems

Advanced tools, such as Celeris Risk Engine, identify suspicious activity and stop fraudulent payments in their tracks, safeguarding merchants and customers alike.

Let's Connect

Just a few quick details. Our team will reach out to explore how our platform fits your payment stack and objectives.

Talk with one of our payment experts

Ready to elevate your business to new heights? Schedule a call with our experts to discuss your unique needs and uncover tailored solutions. Don’t let questions linger – seize the opportunity to pave your path to success!

Winner !

Best use of data analytics, MPE 2025

Best Payments Orchestration Solution, MPE 2024