The Benefits of Payments Orchestration

1. Simplified Integration: With payment orchestration, merchants are able to simplify the integration process significantly. By connecting with a centralized payments orchestration platform, they streamlined their interactions with various payment providers across different markets. This consolidation saved them valuable time, resources, and technical complexities associated with multiple integrations.

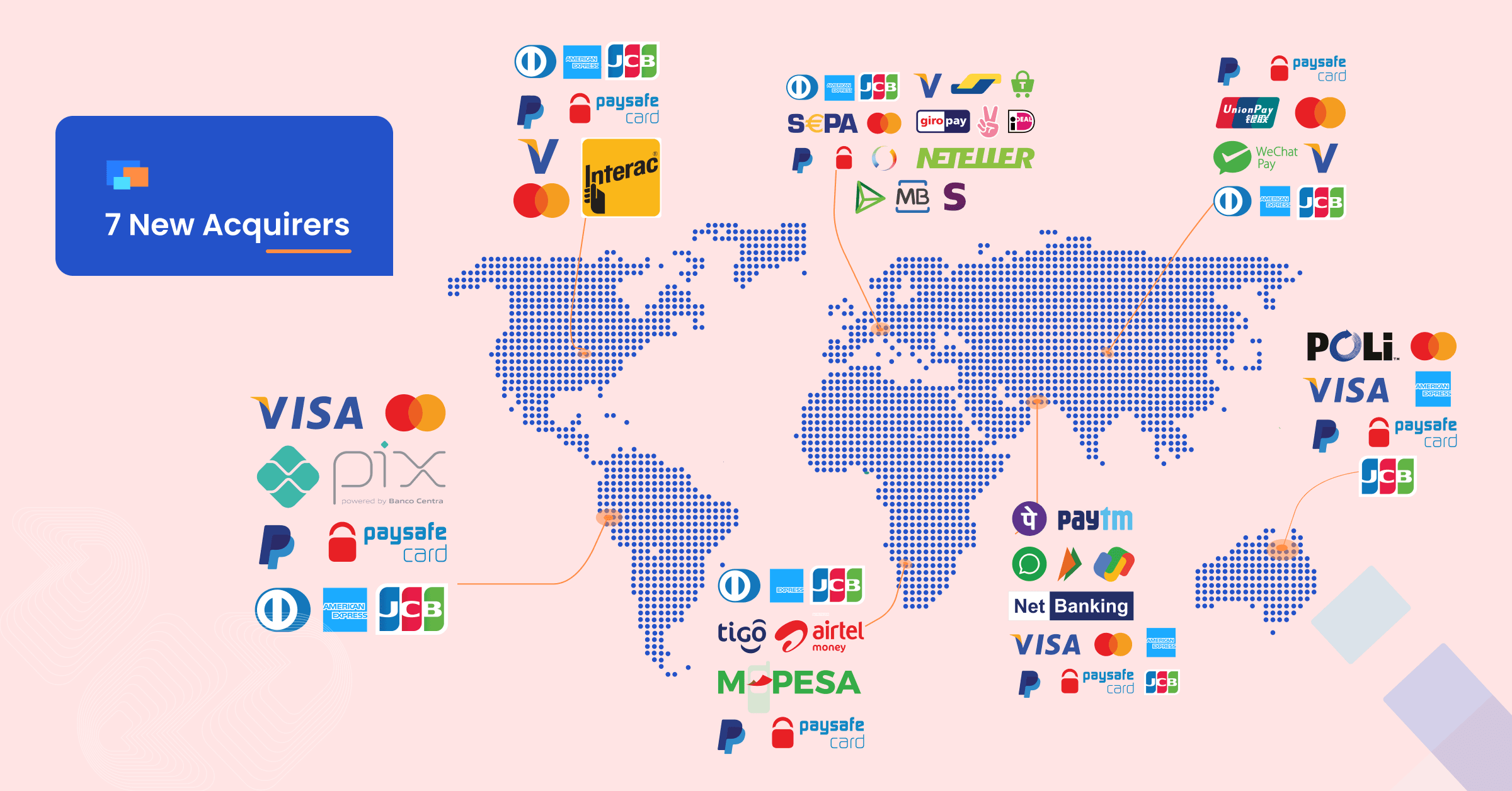

2. Localization and Adaptability: Payments orchestration empowered the merchant to tailor their payment offerings to meet the localized needs of each market. With a unified platform, they seamlessly incorporated region-specific payment methods, currencies, and languages, enhancing the overall customer experience. This localization strategy played a pivotal role in driving higher customer satisfaction and conversion rates.

3. Flexibility and Agility: One of the key advantages of payment orchestration was the flexibility and agility it afforded us. As market dynamics and customer preferences evolved, they could quickly adapt by adding or removing payment options. This nimbleness allowed the merchant to stay ahead of the competition and capitalize on emerging trends, all while scaling their operations seamlessly.

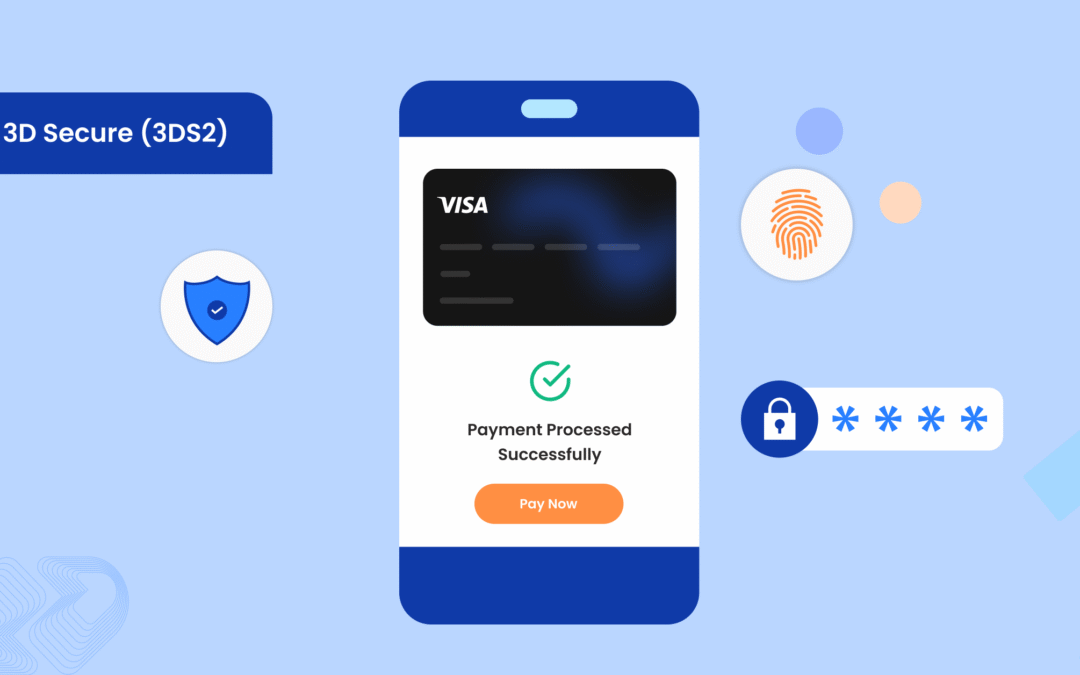

4. Robust Security and Risk Management: Payments orchestration platforms provided the merchant with advanced security features and robust fraud prevention tools. These measures significantly reduced the risk of fraudulent transactions and chargebacks, safeguarding their business interests. The comprehensive risk management capabilities of payments orchestration platforms ensured secure payments across various channels and geographies.