Verifi specializes in dispute management, aiding sellers in revenue retention and cost reduction from banks.

- Resource

- /

- Subscription Payments Gateway Complete Guide

Contents

Recommended Articles

What is Payment Orchestration? A Complete Guide for Businesses in 2026

December 9 2025 | Blog

A Payment orchestration is a software layer that connects your business to multiple payment service providers, acquirers, banks and other financial services through a single platform, it allows you to manage transactions across various partners and optimises success...

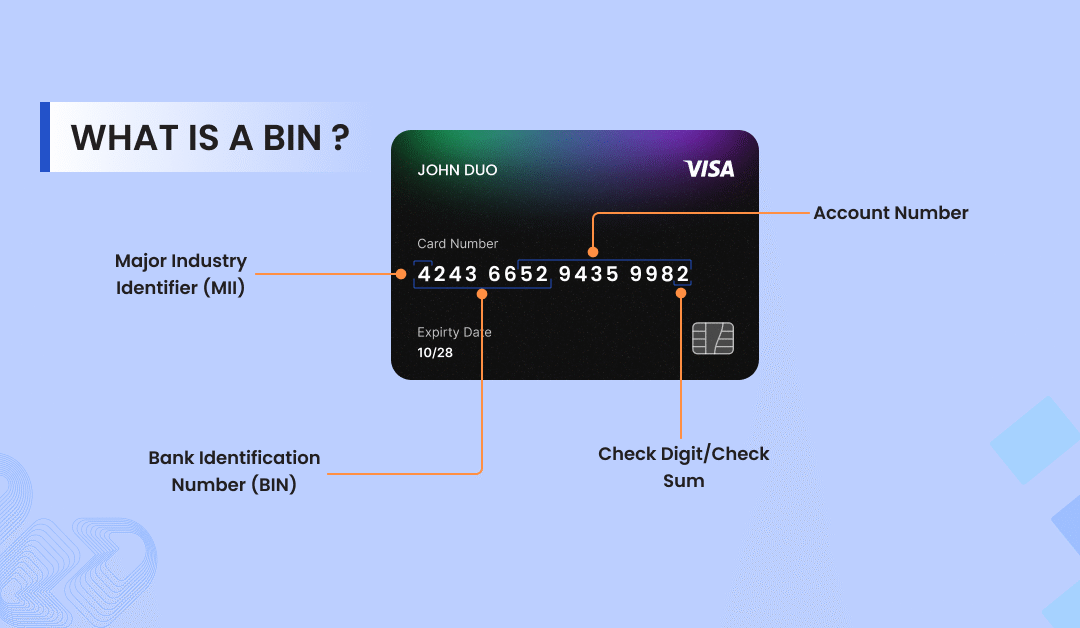

What is BIN in Card Payments? A Guide Every Merchant Need

November 26 2025 | Blog

Most businesses today close sales through conversations, not just via websites or apps. Customers interact with your brand across various channels, including Instagram, WhatsApp, email, and live chat.

Pay by Link: A Smarter Way to Accept Payments in 2025

July 31 2025 | Blog

Most businesses today close sales through conversations, not just via websites or apps. Customers interact with your brand across various channels, including Instagram, WhatsApp, email, and live chat.

Share This Post

Subscription Payments Gateway Complete Guide

By Chetan Chadha on 28/03/2025

Subscription-based businesses are growing rapidly across industries such as Gaming, SaaS, Video on Demand, and e-commerce. Based on research and market forecasts conducted by Juniper Research, a subscription payment economy will be almost 1 trillion dollars globally by 2028.

If you’re running an e-commerce store or you’re a SaaS platform or any business that manages memberships and subscriptions, finding the right subscription payment gateway is a crucial decision for your business. Why? Because it’s more than simply accepting payments. It’s more about ensuring that recurring payments are handled seamlessly, securely, and efficiently.

In this article, we have covered everything you need to know about the subscription payment gateway, including what it is, how payment processing works, payment models, must-have features, and why celeris is the best choice.

What’s in this guide:

-

What is a Subscription Payment Gateway?

-

5 Types of Subscription Payment Models

-

How Does Subscription Payment Processing Work?

-

Must-Have Features for Subscription Payment Gateways in 2025

-

Benefits of Subscription Payments Gateway by Industry Types

-

How to choose the best one for your business?

-

Future Trends in Subscription Payments

-

Why Celeris is the Best Choice for Your Business?

Contents

What is a Subscriptions Payment Gateway?

As many of you already know, a subscription payment gateway or recurring billing solution, whatever you call it, subscription payment gateway helps businesses with processing recurring payments on a scheduled day, based on their plans, which can be weekly, monthly or yearly.

With a subscription payment processing solution like Celeris, our subscription payment solution is designed for business offering subscription services to user, and helping them in every area from managing recurring payments, processing recurring payments and scaling globally.

Not only this, with our solution, we’ve built advanced features for businesses that helps you with automated payments retry for failed payments, an advanced dashboard for deep down analysis of your customer data like usage, billing cycle, behavior, upgrades, downgrades of plans and some advanced features like tokenisation for seamless future recurring payments.

5 Types of Subscription Payment Models

Before choosing the best payment gateway for recurring billing, you need to know what types of subscription payment models are available in the gateway you’re choosing. Here are the most common types of subscription models with an example:

-

Fixed or Flat-Rate Subscriptions: Customers pay the same amount at regular intervals, regardless of usage. This is ideal for services with a standard offering, such as streaming platforms or gym memberships.

-

Usage-Based Subscriptions: Similarly, it is also known as pay-as-you-go, this model charges customers based on their usage. It’s often used by utilities or cloud service providers, offering flexibility to customers where you only have to pay for the server resources that you’ve used.

-

Tiered Subscriptions: Businesses provide multiple pricing tiers, each with a different set of features or usage limits. This allows customers to choose a plan that best suits their requirements, such as basic, premium, or enterprise options.

-

Freemium to Premium: This model offers basic services for free while encouraging customers to pay for advanced features or extra value. It’s common among software applications and online tools.

-

Completion of Transaction: Once the transaction is authorised, the payment gateway relays the authorisation back to the merchant platform, and the transaction will be completed. In any instance, if a transaction is declined, the gateway provides the error message to the customer to retry the payment.

-

Hybrid Subscriptions: A combination of multiple models, such as a flat-rate base price with additional usage-based fees. This approach works well for businesses looking to maximise revenue while retaining flexible options.

How Does Subscription Payment Processing Work?

Many people have questions about how we can charge monthly subscriptions, how recurring billing works, and what tool or software we need to process the subscription pyments every month, in this section we have explained completely the flow of how subscription payment processing works and the role of subscription payment gateway:

-

Customer Sign-Up: The subscription payment process begins with the customer signing up for a service. During this step, the customer fills out a form providing essential information such as their name, billing address, and payment details. These payment details may include credit or debit card information, bank account details, or access to saved payment methods if using a platform like Shopify. The customer also chooses their preferred subscription plan and billing frequency, such as monthly, quarterly, or annually.

-

Secure Payment Information Storage: Once a customer provides their payment details, the sensitive information is securely stored using methods like tokenization. Tokenization stores sensitive payment data in the form of tokens, ensuring the actual data remains protected. At Celeris, we offer tokenization that aligns with Payment Card Industry Data Security Standards (PCI DSS) to safeguard customer information and maintain regulatory compliance.

Read more: What is Tokenization and How Does it Work?

-

Subscription Management System: The customer’s subscription details, including the selected plan, billing preferences, and tokenized payment data, are stored in a subscription management system. This robust system automates recurring billing, ensuring customers are charged according to their selected plan on a scheduled date without any manual intervention.

-

Payment Gateway and Processor Workflow: For each billing cycle, the subscription management system initiates a payment request. This request is submitted to a payment gateway, which then passes it on to a payment processor. The payment processor works with the customer’s bank or card issuer to validate and authorize the transaction, completing the payment process.

-

Transaction Authorization and Status Updates: The customer’s bank or card provider approves or denies the transaction based on factors like account balance or card validity. This status is communicated back through the payment processor and gateway to the subscription management system. For successful payments, services continue without interruption. If a transaction fails, due to issues like insufficient funds or expired cards, the system will trigger notifications to customers to update their payment information and may retry the payment later.

-

Managing Recurring Payments: All the payment details of the customer are then stored in the gateway side like Celeris, we’ll store the data in the form of a token in a secure token vault and the same token will be used on the next billing cycle, and with the help of token, next payments can be done without OTP or CVV.

This automated process is repeated at the start of every billing cycle, creating a hassle-free experience for both the business and the customer. The automation minimizes errors and ensures timely payments, ultimately supporting uninterrupted service delivery.

-

Subscription Updates or Cancellations: Whether customers wish to upgrade, downgrade, or cancel their subscriptions, the payment system efficiently manages these changes. It adjusts billing to reflect new subscription plans or prorates charges if necessary. For cancellations, the system ensures that no further payments are processed, maintaining trust between the customer and the business.

Must-Have Features of Subscription Payment Gateways Your Business Needs in 2025

Before choosing any subscription payment platform from any company, may it be Celeris or another, you should look for these features in subscription payment gateways for your business in 2025, as mentioned below. The subscription solution you’re choosing must provide secure, efficient, and scalable recurring billing solutions for your business growth to maximize the monthly subscription payment processing.

Here are the top features to look for:

1. Smart Dunning Management: Must have automated retry logic built for failed payments that can recover up to 30% of lost revenue.

2. Hybrid Billing Support: The system must support customized subscriptions and one-time purchases, and metered billing ensures flexibility. Look for gateways like CelerisPay, which seamlessly combine subscription and one-off transactions.

3. Global Payment Methods: The solution you choose must offer local payment methods like Apple Pay and Google Pay as well as regional favourites like Pix, iDEAL, QR codes, and Pay by Link. It must also offer automated auto-currency conversion for international scalability.

4. PCI-DSS Compliance & Fraud Prevention: Choose a gateway with tokenization, 3D Secure 2.0, and an AI-driven fraud detection tool like we offer at Celeris for maximum security.

5. Deep API and Integration Options: Must have easy-to-integrate options like APIs and pre-built plugins for platforms like WooCommerce, Magento2, Prestashop, etc., and CRMs for easy integration with your existing tech stack.

6. Detailed Analytics Dashboards: Must have an advanced subscription management dashboard to gain insights into churn predictors, lifetime value (CLTV), and recurring revenue metrics and options for making customized subscription plans and analyzing the user journey all in one place.

7. Self-Service Customer Portals: Choose the one that offers a system like Celeris’s payment gateway for subscriptions, which allows customers to change plans, update cards, or manage cancellations without contacting support.

8. Scale-Resilient Infrastructure: Choose systems that handle traffic spikes without downtime.

9. Dedicated Support Team: Before selecting any subscription payment gateway must look for the one that’s available for support to resolve issues immediately.

Use these features as a checklist during your evaluation process.

Benefits of Subscription Payments Gateway by Industry Types

1. SaaS Providers

-

Handles complex billing needs (e.g., per-user, usage-based).

-

Prorates changes to minimize billing disputes.

-

Supports global customer bases with multi-currency options and local payment methods.

2. eCommerce and Retail Subscription Boxes

-

Allows easy customer onboarding with self-service portals.

-

Provides auto-renewal for loyalty programs or monthly shipments.

3. Streaming Platforms

-

Delivers seamless mobile-first transactions.

-

Supports millions of transactions globally with high uptime.

-

Charge recurring billing based on the plans.

4. Gaming and VOD

-

Handles microtransactions and add-ons securely.

-

Enables free trials and subscription tier upgrades smoothly.

5. Dating and Membership Apps

-

Improves user retention with flexible pricing tiers.

-

Reduce churn with dynamic retry mechanisms for failed payments.

How to choose the best one for your business?

Although selecting the right payment gateway requires many observations and factors, as we’ve already discussed all the important requirements, and by following this guide, you can easily pick the right one for you. Follow this 5-step framework:

1. Map Your Business Model: Firstly, based on your business, is it B2B or B2C? Do you need per-user pricing or usage-based billing? We’ve already covered the benefits and all the things above in the blog, which can help you define your subscription model and ensure to choose a gateway that supports your billing structure business needs.

2. Audit Your Technical Needs: Assess your systems for API compatibility, webhook support, and integration with existing platforms like HubSpot or ERP systems.

3. Prioritize Compliance & Security: Ensure the gateway meets PCI DSS Level 1 standards and supports regional rules such as PSD2.

4. Test the Customer Journey: Check that payment flows are mobile-friendly, secure, and frictionless. Test plan upgrades, downgrades, and cancellations in sandbox environments.

5. Compare Total Cost of Ownership (TCO): Look beyond transaction fees. Factor in setup costs, maintenance, and support quality. For example, choose the one with the best and most affordable pricing model.

Future Trends in Subscription Payments

Stay ahead by adapting to these trends in subscription billing:

1. AI-Driven Automation: AI tools will enhance churn prediction, implement smarter dunning workflows, and customize billing strategies in real time.

2. Embedded Finance: Expect features like in-app wallets and instant payouts to enhance flexibility

3. Cryptocurrency Payments: The integration of stablecoins and crypto wallets for subscriptions is gaining traction.

4. Geo-specific pricing: Dynamic pricing by region will become the norm, enabling higher customer retention.

Why Celeris is the Best Choice for Your Business in 2025

Among various subscription payment gateway available in the market, why you should choose Celeris?

-

Cost Efficiency: Most of the solutions available in the market charge higher transaction fees of up to 2.5% and higher per transaction. But Celeris offers affordable and custom plans based on your transaction volume, business size, and many other factors.

-

Global Scalability: We support 150+ currencies and localized payment methods.

-

Hybrid Billing Flexibility: We provide subscriptions and one-off purchases with ease.

-

Intuitive Dashboard: With Celeris, you’ll get an advanced dashboard for customizing plans to analyze the very important factors of your customers with an easy-to-use feature like Billing Cycle, Churn Rate, Customer Usage, and other factors.

Resources of the Article

Javelin Strategy: Processing Recurring and Subscription Payments Without Friction: A Key to Unlocking Transactions from a Forecasted $830 Billion Card Market

GOV.UK: Future of Payments Reviews

Juniper Research: Global Subscription Economy Market: 2024-2028

Let's Connect

Just a few quick details. Our team will reach out to explore how our platform fits your payment stack and objectives.

Talk with one of our payment experts

Ready to elevate your business to new heights? Schedule a call with our experts to discuss your unique needs and uncover tailored solutions. Don’t let questions linger – seize the opportunity to pave your path to success!

Winner !

Best use of data analytics, MPE 2025

Best Payments Orchestration Solution, MPE 2024