Verifi specializes in dispute management, aiding sellers in revenue retention and cost reduction from banks.

- Resource

- /

- Optimising Checkout Experiences: A Guide to Improving Payment Conversion

Contents

Recommended Articles

What is Payment Orchestration? A Complete Guide for Businesses in 2026

December 9 2025 | Blog

A Payment orchestration is a software layer that connects your business to multiple payment service providers, acquirers, banks and other financial services through a single platform, it allows you to manage transactions across various partners and optimises success...

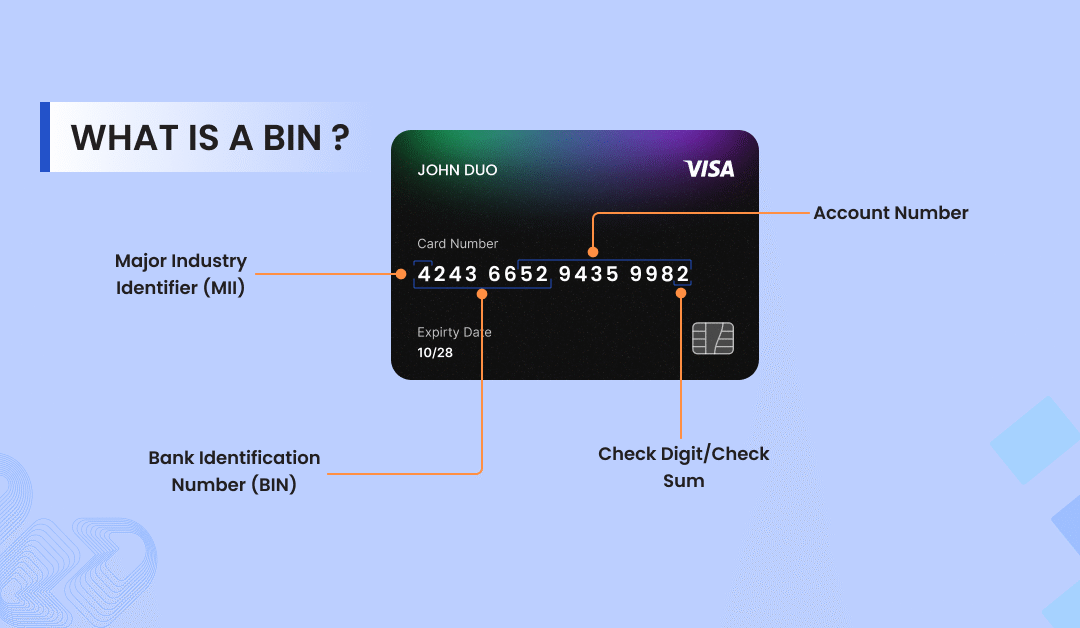

What is BIN in Card Payments? A Guide Every Merchant Need

November 26 2025 | Blog

Most businesses today close sales through conversations, not just via websites or apps. Customers interact with your brand across various channels, including Instagram, WhatsApp, email, and live chat.

Pay by Link: A Smarter Way to Accept Payments in 2025

July 31 2025 | Blog

Most businesses today close sales through conversations, not just via websites or apps. Customers interact with your brand across various channels, including Instagram, WhatsApp, email, and live chat.

Share This Post

Optimising Checkout Experiences: A Guide to Improving Payment Conversion

By Abhishek Singh on 29/11/2024

The checkout experience is a critical stage in any online purchase. It’s where potential customers can either complete their journey or abandon their journey resulting in a no sale, making it crucial for businesses to optimise this stage for higher conversions. Different payment checkout technologies provide unique experiences, each offering distinct benefits. In this post, we’ll explore four checkout options and analyse their customer experience, conversion uplift, and security/PCI impact.

Contents

Merchant-Branded Hosted Payment Page

Customer Experience:

A Merchant-Branded Hosted Payment Page redirects customers to a secure page hosted by the payment provider such as Celeris. While the page is controlled externally, it can still be customised with the merchant’s branding and colour schemes, ensuring a seamless look and feel. Once customers complete the payment, they are typically redirected back to the merchant’s site.

Conversion Uplift:

Merchant-branded hosted payment pages offer security, but often reduce trust, the extra step of redirecting customers can sometimes result in cart abandonment. On average, businesses may see a 5-10% drop in conversions due to the friction caused by redirects and additional steps in the process. However, trust in a well-known payment processor can also reassure users and reduce hesitation in entering sensitive information – Using the right provider can also support added customisations but providing the option to present relevant or recently used payment methods, or payment methods more popular with the customer currency of choice or current location. This can help to minimise the impact of the 5-10% conversion drop identified.

PCI Requirements:

Using a hosted payment page is the simplest way to reduce PCI compliance scope for the merchant. Since payment data is never handled directly by the merchant’s servers, compliance falls under the payment provider’s responsibility, usually SAQ-A can be achieved, making this an attractive option for businesses looking to minimise their to the lowest level of PCI burden.

Key Benefits:

- Trust: Association with a well-known, secure payment provider.

- Reduced PCI scope: The payment provider handles compliance, relieving the merchant.

- Customisation: Branding can be applied to create a seamless transition for the user.

Lightbox Checkout (No Redirect & Branded)

Customer Experience:

A Lightbox Checkout opens a secure merchant branded payment form in an overlay (lightbox) on the merchant’s website without redirecting the user to an external page. The payment experience feels integrated, and users never leave the merchant’s site, enhancing continuity and reducing the perception of a disjointed experience.

Conversion Uplift:

This method provides a balance between security and user experience. Since users don’t have to leave the page, conversion rates can improve by 15-25%, as the process feels smoother and more trustworthy. Additionally, the embedded experience reduces friction, often leading to fewer abandoned carts.

PCI Requirements:

Although the lightbox appears on the merchant’s site, the payment data is handled by the payment provider, not the merchant. This reduces the PCI scope significantly meaning that SAQ-A can be potentially achieved easily. The merchant must still ensure that their overall environment is secure, but they won’t need to meet the more stringent PCI requirements of handling sensitive card data directly.

Key Benefits:

- Improved conversion: A smoother, embedded experience keeps users on the merchant’s page.

- Reduced PCI burden: Similar to hosted pages, compliance largely rests with the payment provider.

- Brand continuity: The form can be branded to align with the merchant’s look and feel.

Hosted Fields

Customer Experience:

Hosted Fields allow merchants to embed individual fields for payment details (such as card number, expiration date, etc.) directly into their checkout form while those fields are hosted by the payment provider. The user stays on the merchant’s website, with the sensitive card information being captured securely by the provider in the hosted fields.

The form looks and feels completely native to the website, with no indication that an external provider is handling the sensitive payment data behind the scenes.

Conversion Uplift:

Hosted fields provide a frictionless and trustworthy experience for users, often leading to conversion rate improvements of 20-30%. Since users remain on the site and the payment form can be customised to fit seamlessly into the merchant’s brand, the checkout process feels intuitive and less intimidating for the customer.

PCI Requirements:

This option still offloads much of the PCI compliance responsibility to the payment provider since the sensitive card data is hosted and processed externally. The merchant is responsible for ensuring that the implementation is secure, but they are not handling cardholder data directly which means SAQ-A can be potentially achieved.

Key Benefits:

- Seamless experience: Users feel they’re interacting solely with the merchant, fostering trust.

- High conversion rates: Reduced friction and a native checkout environment result in higher completed transactions.

- Minimal PCI scope: Sensitive payment data is hosted externally, limiting compliance needs.

One-Line Hosted Field

Customer Experience:

A One-Line Hosted Field is a single, minimal input field integrated into the merchant’s checkout page. It typically allows users to enter all their payment details in a condensed, user-friendly format, reducing the number of fields on the form. This approach offers a very streamlined experience, making it ideal for mobile checkouts or quick payments where simplicity is key.

Conversion Uplift:

The simplicity of the one-line hosted field can dramatically improve conversion rates, particularly on mobile devices. By reducing the number of visible input fields and simplifying the checkout process, merchants can see conversion increases of up to 35%, especially with customers who value speed and convenience.

PCI Requirements:

Similar to other hosted options, the one-line hosted field transfers PCI compliance responsibility to the payment provider. Merchants are not handling any sensitive card information, thus remaining outside the most stringent levels of PCI compliance with SAQ-A achievable. This makes it a secure and efficient choice for merchants looking to reduce complexity.

Key Benefits:

- Maximised conversions: The minimalist design is particularly effective for mobile users, leading to significant conversion uplift.

- Reduced PCI scope: Like other hosted solutions, it limits the merchant’s exposure to compliance risks.

- Faster checkout: Fewer fields and a quicker process increase user satisfaction, reducing friction.

In Summary

Choosing the right checkout option is a balance between user experience, security, and compliance, selecting the right payment option for your business can enhance customer trust, simplify compliance, and significantly boost your conversion rates. Each option offers a unique balance of user experience and security, so assess your business needs and customer behaviour to choose the most effective solution.

It is also important to consider the payment options available within each feature and ensure that the relevant payment option is provided for the right customer. Optimisation for the mobile user is essential whilst providing mobile wallets like Apple Pay and Google Pay. Those business with returning customers should use stored card functionality which can reduce checkout times by up to 50 seconds and improve conversion by up to 70%.

Looking to enhance your checkout experience then feel free to get in touch here and speak to one of the Celeris team.

Let's Connect

Just a few quick details. Our team will reach out to explore how our platform fits your payment stack and objectives.

Talk with one of our payment experts

Ready to elevate your business to new heights? Schedule a call with our experts to discuss your unique needs and uncover tailored solutions. Don’t let questions linger – seize the opportunity to pave your path to success!

Winner !

Best use of data analytics, MPE 2025

Best Payments Orchestration Solution, MPE 2024