Verifi specializes in dispute management, aiding sellers in revenue retention and cost reduction from banks.

Asked

What is payment orchestration?

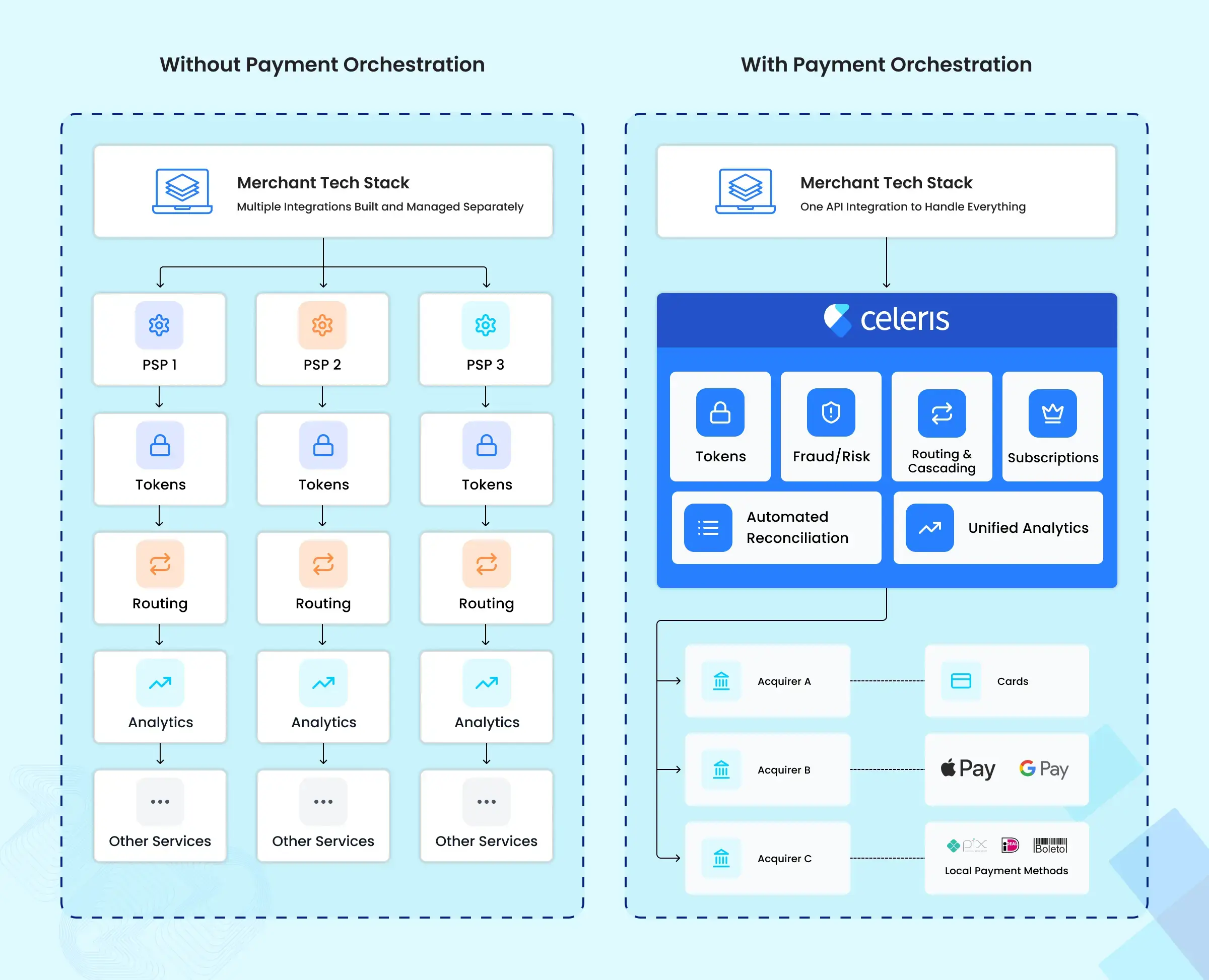

Payment orchestration is a software layer that connects a merchant to multiple payment providers, allowing for centralised management and optimisation of all transactions.

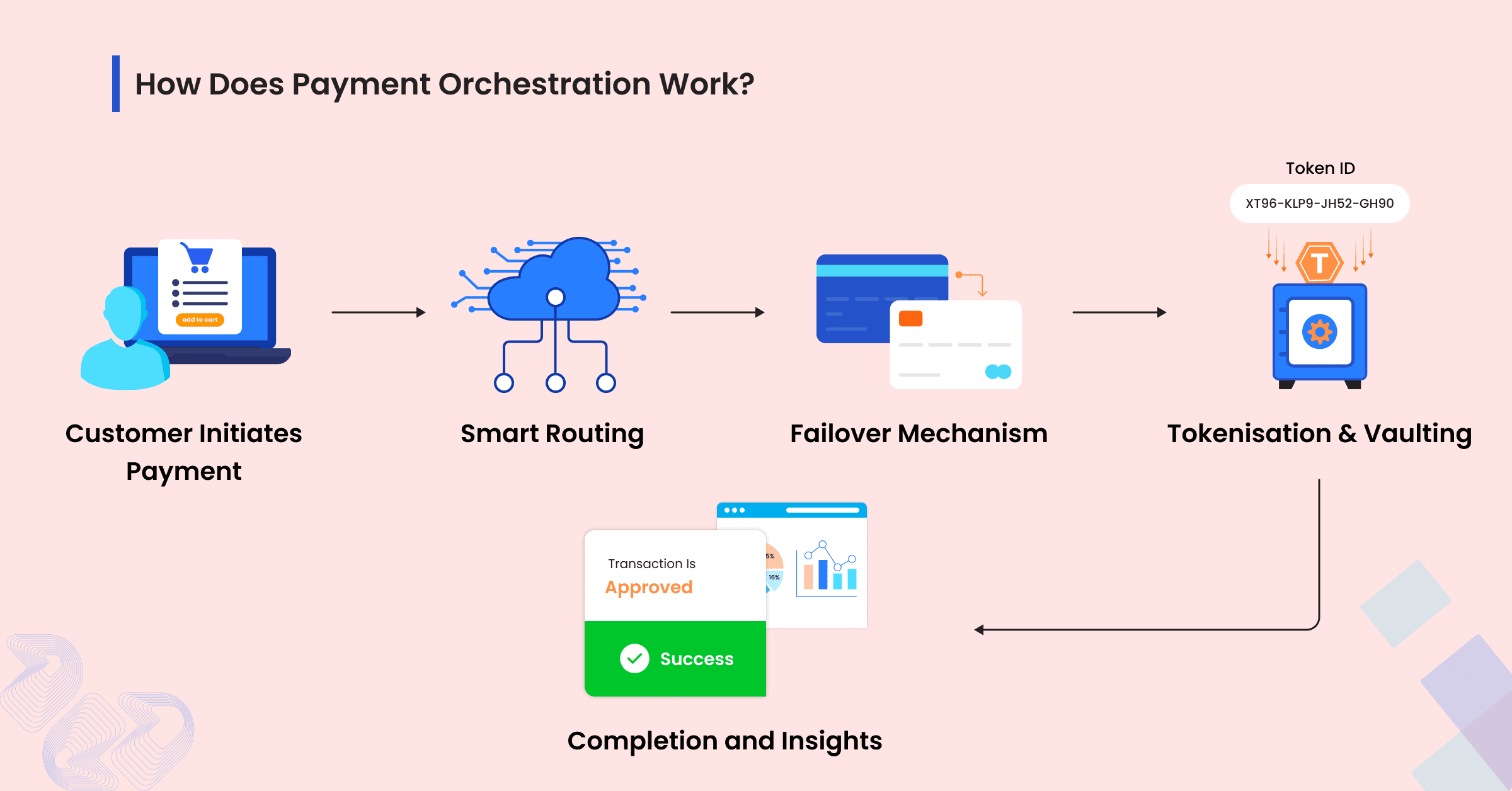

How does payment orchestration work?

What are the benefits of payment orchestration?

How is payment orchestration different from a payment gateway?

How does smart routing work?

What type of industries benefits the most from payment orchestration?

How does payment orchestration handle failed transactions?

How do I choose the right payment orchestration platform?

How much payment orchestration platform costs ?

How does payment orchestration handle failed transactions?

Does payment orchestration support recurring payments?

What are the risks of using payment orchestration?

Why do approval rates differ between countries?

How does a POP connect to PSPs?

What is required for PSD2/SCA compliance?

How long does integration take?

Let's Connect

Just a few quick details. Our team will reach out to explore how our platform fits your payment stack and objectives.

Talk with one of our payment experts

Ready to elevate your business to new heights? Schedule a call with our experts to discuss your unique needs and uncover tailored solutions. Don’t let questions linger – seize the opportunity to pave your path to success!

Winner !

Best use of data analytics, MPE 2025

Best Payments Orchestration Solution, MPE 2024