Verifi specializes in dispute management, aiding sellers in revenue retention and cost reduction from banks.

- Resource

- /

- Payment Orchestration Trends to Keep an Eye on in 2025

Contents

Recommended Articles

What is Payment Orchestration? A Complete Guide for Businesses in 2026

December 9 2025 | Blog

A Payment orchestration is a software layer that connects your business to multiple payment service providers, acquirers, banks and other financial services through a single platform, it allows you to manage transactions across various partners and optimises success...

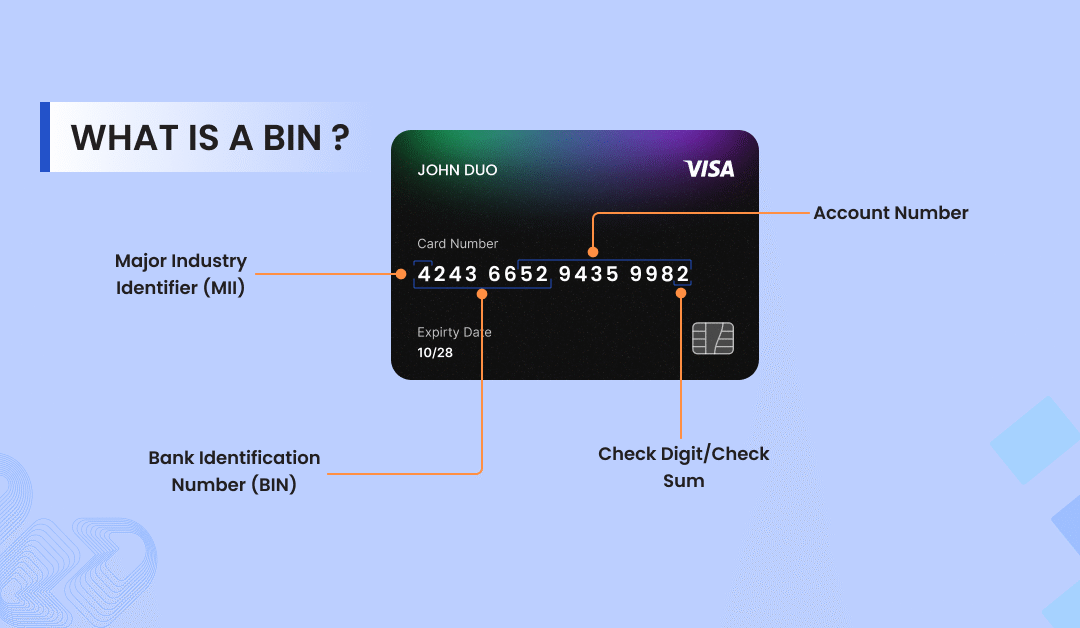

What is BIN in Card Payments? A Guide Every Merchant Need

November 26 2025 | Blog

Most businesses today close sales through conversations, not just via websites or apps. Customers interact with your brand across various channels, including Instagram, WhatsApp, email, and live chat.

Pay by Link: A Smarter Way to Accept Payments in 2025

July 31 2025 | Blog

Most businesses today close sales through conversations, not just via websites or apps. Customers interact with your brand across various channels, including Instagram, WhatsApp, email, and live chat.

Share This Post

Payment Orchestration Trends to Keep an Eye on in 2025

By Chinmay Jain on 19/02/2025

Technology innovations, changing customer demands, and the rising complexity of global trade contribute to the payments landscape’s extraordinary rate of change. As companies work to provide smooth, safe, and customised payment experiences, payment orchestration has become a vital success factor. Celeris understands how important it is to stay on top of trends, so in this article, we’ll examine the main payment orchestration trends in 2025.

You can Read Everything about Payment Orchestration: What is payment orchestration?

Contents

6 Must-Watch Payment Orchestration Trends for 2025

Rise of AI and Machine Learning in Payment Optimization

In 2025, payment orchestration will likely experience an essential change thanks to artificial intelligence (AI) and machine learning (ML). Businesses can now analyse massive amounts of transaction data in real-time, detect trends, and make smart choices to maximise payment routing thanks to these tools.

Celeris guarantees seamless, scalable, and intelligent payment processing, making it a prime example of the optimal application of data analytics and AI in payment orchestration. It sets the standard for contemporary payment infrastructure due to its capacity to dynamically adjust to shifting market conditions and merchant demands. Also, Celeris leverages Machine Learning to optimise payment processing by predicting transaction success, reducing fraud, and enhancing intelligent routing. Our ML-driven insights help businesses increase approval rates, minimise payment failures, and improve overall revenue efficiency.

Increased Adoption of Unified Commerce Platforms

Businesses will increasingly rely on unified commerce platforms in 2025, integrating payment orchestration with analytics, CRM, and inventory management tools to deliver a seamless and personalised experience across online, in-store, and mobile channels.

Celeris enables this transformation by offering robust payment orchestration solutions that streamline the transfer of payment data across platforms. With Celeris, multichannel merchants can ensure effortless shopping experiences, reduce friction, and gain deeper insights into customer behaviour, making it easier to optimise operations and drive revenue growth.

Enhanced Focus on Payment Security and Compliance

As payment ecosystems become increasingly complex, businesses will continue emphasising security and compliance in 2025complex. Celeris helps tackle these challenges by implementing tokenisation, encryption, and multi-factor authentication to protect sensitive data and prevent fraud.

As new payment and data privacy regulations come into effect, Celeris also streamlines compliance with its advanced automated reporting and audit management tools. These tools enable businesses to navigate the evolving regulatory landscape with ease. By integrating these capabilities into its payment orchestration platform, Celeris ensures security and compliance while enhancing operational efficiency.

Expansion of Alternative Payment Methods (APMs)

Digital wallets and cryptocurrencies are examples of alternative payment mechanisms (APMs) that will continue to gain popularity in 2025. As customers increasingly seek payment methods that align with their preferences and lifestyles, businesses must adapt to remain competitive.

Celeris can help by providing tools like payment orchestration platforms that support a wide range of APMs, ensuring seamless integration and compatibility. Businesses can attract global customers and reduce cart abandonment rates by offering features like multi-currency support, dynamic routing for payment optimisation, and integration with popular digital wallets and crypto gateways.

Real-Time Payments and Settlements

Customers’ demands for immediate satisfaction will drive the growth of real-time payments and settlements in 2025. For companies to provide quicker and more effective transactions, payment orchestration systems will need to provide real-time payment processing.

By enabling real-time payment processing, Celeris can help businesses meet the growing demand for real-time payments and settlements in 2025. It supports dynamic pricing, allowing companies to adjust prices instantly based on demand. They also facilitate customised offers tailored to individual customer behaviour and preferences, enhancing customer satisfaction. Additionally, Celeris streamlines instant refunds, ensuring a seamless and efficient transaction experience that meets modern customer expectations.

Localization for Global Expansion

Localisation will be a critical focus for payment orchestration in 2025 as companies expand into new markets. This involves complying with regional regulations and supporting diverse currencies, languages, and payment methods. Payment orchestration solutions, such as Celeris, can help businesses achieve this by offering tools to customise payment strategies for specific markets.

Celeris enables companies to integrate localised payment methods, adapt to regional compliance requirements, and provide multilingual support, ensuring a seamless payment experience for customers. By leveraging these capabilities, businesses can enhance conversion rates and build stronger client relationships through tailored, localised payment experiences.

Why Payment Orchestration Matters for Your Business

In a rapidly changing payment landscape, payment orchestration is no longer optional—it’s essential. By adopting a payment orchestration platform, businesses can:

-

Improve payment success rates and reduce costs

-

Enhance the customer experience with seamless and personalised payments

-

Stay ahead of emerging trends and technologies

-

Ensure compliance with evolving regulations

-

Expand into new markets with confidence

How Celeris Can Help

At Celeris, we specialise in providing cutting-edge payment orchestration solutions tailored to your business needs. Our platform is designed to help you navigate the complexities of the payments ecosystem, optimise your payment processes, and deliver exceptional customer experiences. As we look ahead to 2025, we’re excited to partner with businesses like yours to embrace the latest payment orchestration trends and drive growth in a rapidly evolving world.

Conclusion

The future of payment orchestration is bright, with exciting trends on the horizon that promise to transform the way businesses process payments. At Celeris, we’re here to help you stay ahead of the curve. Contact us today to learn more about our payment orchestration solutions and how we can support your business goals.

Let's Connect

Just a few quick details. Our team will reach out to explore how our platform fits your payment stack and objectives.

Talk with one of our payment experts

Ready to elevate your business to new heights? Schedule a call with our experts to discuss your unique needs and uncover tailored solutions. Don’t let questions linger – seize the opportunity to pave your path to success!

Winner !

Best use of data analytics, MPE 2025

Best Payments Orchestration Solution, MPE 2024