Paysafe Limited is a multinational online payments company providing businesses with payment processing and digital wallets.

White Label solutions for every business need

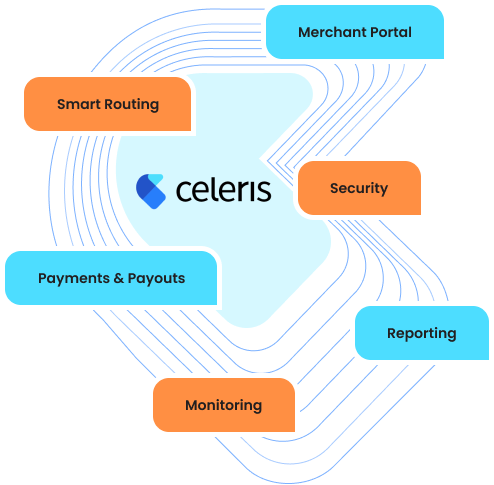

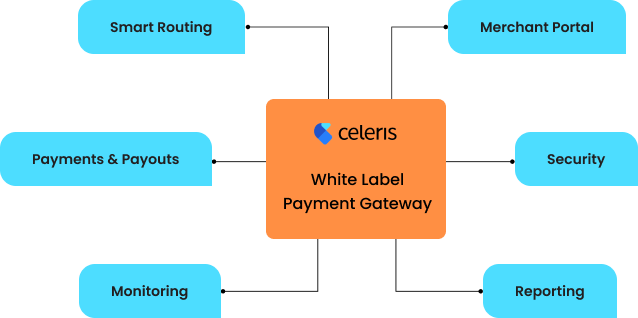

Elevate your payment processing with Celeris White Label Payment Orchestration Platform, featuring a multi-acquirer setup, streamlined onboarding, and a suite of tools designed to optimise transactions and enhance security.

Tap into cutting-edge tech for a versatile, intelligent solution.

Grow effortlessly with our advanced white-label solutions.

Get Access to an advanced White-Label orchestration platform for all your payment needs

SIMPLER . SMARTER . SCALABLE . SECURE . SEAMLESS . STABLE .

Brandable Software Suitable

For Various Business Types

Optimise payments with our flexible white-label gateway for your needs. Transparent pricing, comprehensive control for enhanced capabilities.

Ensure brand consistency. Our customisable gateway provides trusted payments, robust security, scalability, and analytics for adaptive business growth.

Enhance acquirer services with our branded, compliant platform—scalable for new markets, and diverse merchants.

CelerisPay is an ideal solution for banks offering agility, flexibility, advanced analytics, and compliance. Empower digital innovation, and deliver unmatched value.

Expand revenue with an e-commerce gateway and virtual terminal. Empower sales organizations to boost revenue through brand ownership, effortless onboarding, and intelligent payment routing.

Innovate your fintech offerings with our white-label solutions, providing branded payment processing. CelerisPay focus on innovation will elevate the Fintechs customer experiences and boost engagement and loyalty.

One integration gives access to all the payment methods, wallets, markets and countries you need.

Comprehensive suite of 20+ plugins, wrappers and SDKs - - Get integrated in minutes with our No-Code platform!

Control your transaction flow, manage fraud, grow your revenue and explore the route to better success rates.

Provide Risk protection and easy Vendor switching. With this powerful tool on board, you can easily implement and alter various flow strategies.

Activate the checkout flow that gives your customers a frictionless experience and results in the higher acceptance rates. Our Checkout solution caters to consumers with international support for 100+ payment methods, 25 languages, and geolocation adaptability

Effortlessly onboarding merchants, setting up transaction rules, and managing fraud with a simple click.

Ensure robust security for your payment operations with our orchestration dashboard, offering comprehensive features to protect your transactions and data.

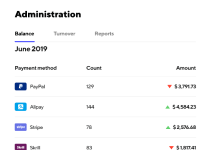

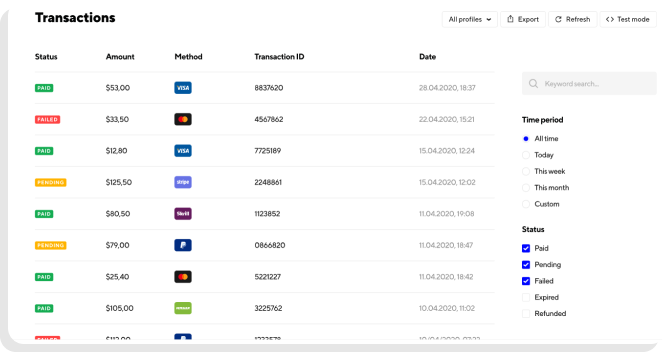

Manage payment process and integrations and all operations from a single dashboard

Reconciliation and Omission reporting. Have your own controller, CFO and administrator in one.

Quick and practical support on simple and complex technical questions.

One Integration . more opportunities . One Integration . more opportunities .

Our White Label Solution Includes

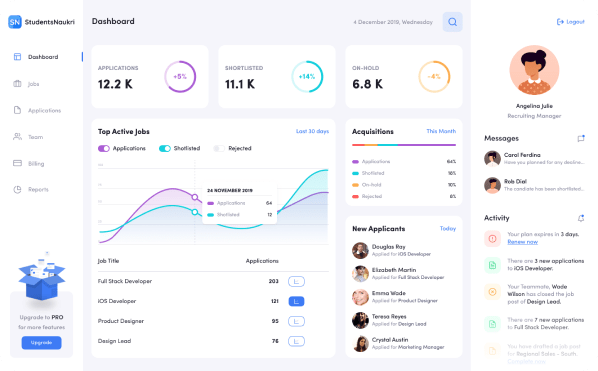

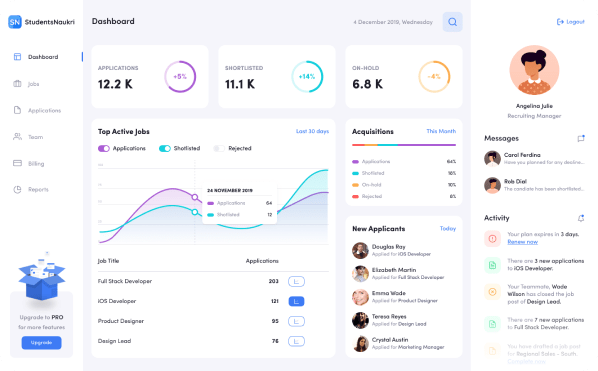

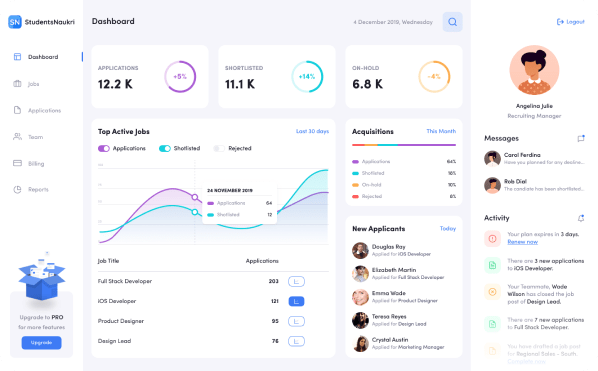

Get Access to an advanced merchant portal for all your activity with enterprise level functionality

Simplify your payment operations with Celeris. Access your account, track data, oversee integrations, process payments, and manage refunds—all through one intuitive dashboard

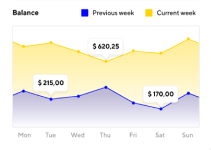

Empower merchants with real-time monitoring for seamless transactions and enhanced security.

Comprehensive predefined and customisable reports to optimise payment operations and drive growth.

Real-time actionable insights and notifications into the lagging customers, frontrunners or outliers.

Prioritized High Security

industry standards

Enhance security and speed with advanced risk and volume/velocity management.

Boost fraud prevention and customer satisfaction with Ethoca/Verifi notifications.

Protects against identity theft, and reduces credit card fraud by setting robust security standards.

Transform security and transactions with network tokenization

Explore the transformative impact of buying our White label payment service provider.

What our customers

What our customers

What our customers and partners say:

What our customers and partners say:

Build your business with Celeris

Frequently Asked Questions

Frequently Asked Questions

Celeris' White Label payment orchestration platform allows PSPs, ISOs, Fintechs, and Acquirers to customize and market the platform as their own, incorporating their unique brand, logo, and identity. The platform enables them to efficiently manage payment flows, offer modern centralized merchant services, and deliver precise reporting to their global online merchants.

PCI DSS, or Payment Card Industry Data Security Standard, is a set of security measures designed to safeguard consumer credit card data and shield businesses from fraudulent activities.

Every organization regardless of its size and transaction volume, that handles credit, debit, or prepaid card data from major card networks like American Express, Discover, JCB, MasterCard, and Visa Inc. must adhere to the PCI standard.

No, Celeris is not a payment service provider (PSP). It is a payment orchestration platform that serves as a technical intermediary between merchants and their PSPs. It offers an independent and adaptable setup, enabling merchants to connect with multiple PSPs and acquirers. Celeris centralizes payment setups, facilitating intelligent transaction routing, risk management, user-friendly reconciliation and settlements, and additional functionalities.

Yes, you can. To ensure a successful data import, both parties involved in the transfer must demonstrate PCI standard compliance by providing a certificate of compliance. These parties include Celeris and the current holder of the merchant's data, such as a PSP, an acquirer, or the merchant itself. For more information, please reach out to our payment platform experts.

Celeris offers a robust risk management engine customizable to your needs, aiming to prevent fraud and mitigate payment risks. Our integrated system includes various risk rules and models, reducing manual reviews and enhancing fraud detection. Collaborations with Ethoca, Verifi, and Chargeback help ensure real-time alerts for added security.