Verifi specializes in dispute management, aiding sellers in revenue retention and cost reduction from banks.

- Resource

- /

- Reconciliation and its importance

Contents

Recommended Articles

What is Payment Orchestration? A Complete Guide for Businesses in 2026

December 9 2025 | Blog

A Payment orchestration is a software layer that connects your business to multiple payment service providers, acquirers, banks and other financial services through a single platform, it allows you to manage transactions across various partners and optimises success...

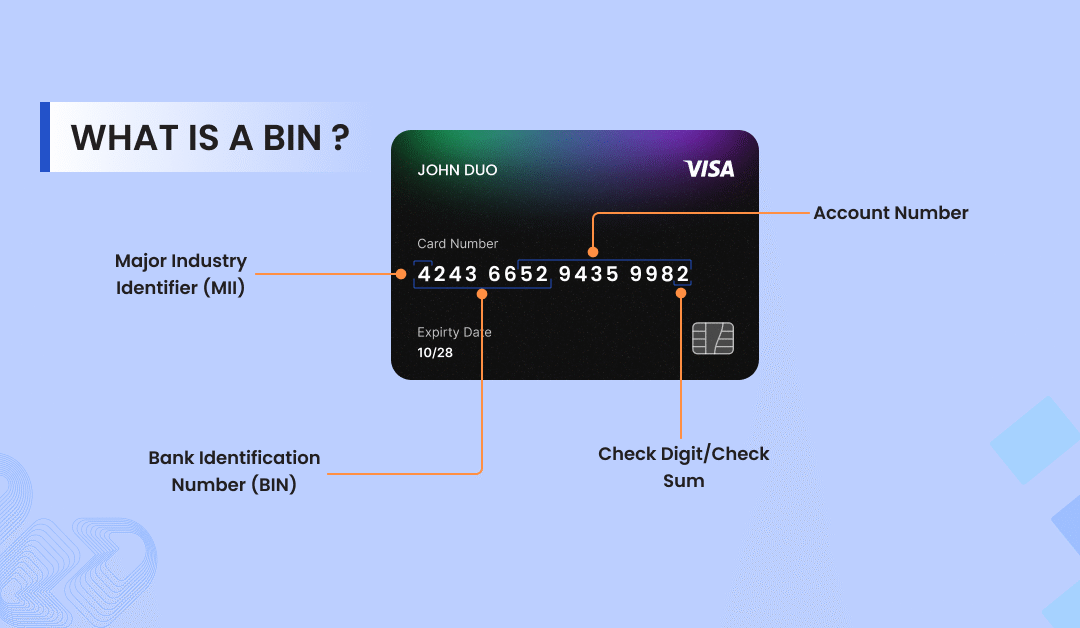

What is BIN in Card Payments? A Guide Every Merchant Need

November 26 2025 | Blog

Most businesses today close sales through conversations, not just via websites or apps. Customers interact with your brand across various channels, including Instagram, WhatsApp, email, and live chat.

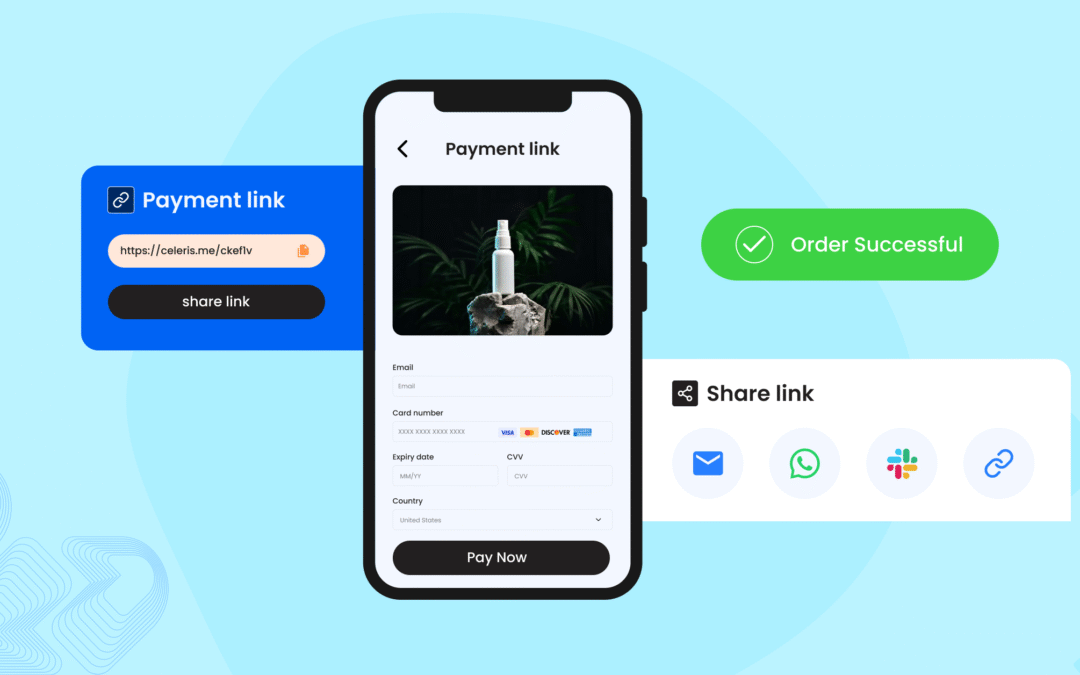

Pay by Link: A Smarter Way to Accept Payments in 2025

July 31 2025 | Blog

Most businesses today close sales through conversations, not just via websites or apps. Customers interact with your brand across various channels, including Instagram, WhatsApp, email, and live chat.

Share This Post

Reconciliation and its importance

By Chetan Chadha on 26/06/2020

No matter the size of your business, reconciliation is one of the primary issues within accounting that takes on a life of its own. Let’s find out why it is important for your company and also look at the fundamental challenges associated with this internal control mechanism.

Contents

What is payment reconciliation and why is it so important?

The reconciliation process commences with files sent from acquirers to merchants, containing all the processed transactions and the fees applied to each transfer. Subsequently, financial accountants utilize these files to match them against the company’s bank statements and/or transaction records. Reconciliation constitutes an essential component of the reporting cycle, provides the complete picture on your business’ cash-flows, helps you identify discrepancies and is a key indicator of a firm’s financial integrity. Overall, it is essential for faultless, cost-effective, prompt and compliant financial reporting and business planning.Have you really received all of your money?

Before starting reconciliation it is crucial to first verify that the reconciliation files you have received from your bank are error-free. This entails making sure that the bank has not made any errors and that all of your money is paid out. This first step is especially crucial for service providers and e-commerce companies that are working with digital goods, as the lack of physical inventory makes it difficult to validate whether the amounts received actually match the services provided. Particularly, if you do not have extensive knowledge in payments or full visibility of all the transactions, you need to be aware that mistakes can happen. Hence, it is important to make sure that you have a good overview of the received payments, which can be achieved by having a proper gateway technology which eliminates the mistakes that could have been made by other parties.Why is payment reconciliation such a challenge?

After you have validated that the money you have received matches against the services you have provided, you can continue with the reconciliation process. At first glance, payment reconciliation might appear to be a straightforward process, however in reality, the process presents many challenges to the accountants and analysts. In fact, for small firms reconciliation ranks among the top three operational activities that demand most time and energy, while for large organizations this is the fifth most cumbersome activity. These challenges arise from having multiple acquirers, different time frames for payment methods, diverse file formats, and refunds. Now let’s take a closer look at all of the above-mentioned issues and how you can solve them.Multiple acquirers, time-frame policies and file formats

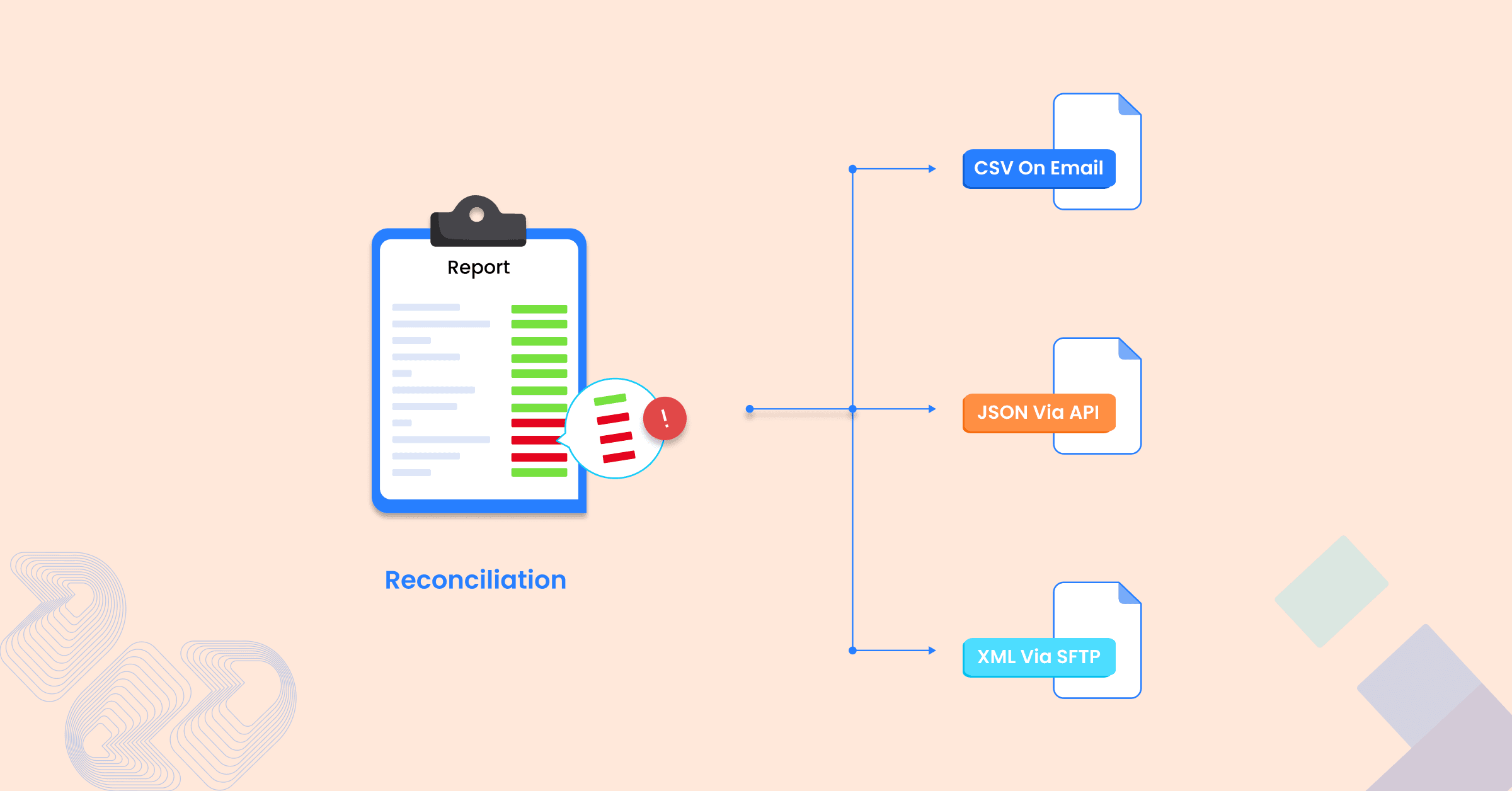

Utilizing multiple acquirers is a common practice for both small and medium-sized enterprises. There are various benefits associated with having multiple acquiring relationships, such as cascading, robustness, reduced fees, and many other advantages. However, most acquirers have unique fee and settlement structures and while intelligent routing can aid in efficient fee distribution, this underlying structure complicates reconciliation. Furthermore, different acquirers have various practices for sending reconciliation files, for instance via APIs, SFTP or email, and all of these files arrive at different times, based on the payment methods. For instance, reconciliation files for transactions based on iDeal and Giropay normally arrive within a few days, while files for credit card transactions arrive weekly or every other week. Lastly, the files are often sent in various formats such as Excel, CSV, PDF or even Text, which constitutes another tedious task for merchants of converting the files. Evidently, reconciliation files arrive at different time points and in bits, which makes reconciliation even more time consuming and convoluted.

Refunds and charge-backs

In the era of digital transactions, consumers value prompt refunds and hence businesses have recognized the significance of timely refunds in supporting their customer value proposition. However, refunds and chargebacks also add another layer of complexity to reconciliation, as expediting a refund without reconciling it first can substantially increase a company’s financial risk. For instance, fraudulent transactions or refunds for payments that did not go through in the first place can cause appreciable losses and require a lot of effort to resolve. Moreover, refunds and charge-backs create a tangle of confusion between bank statements and reconciliation files, which the finance department is left to sort out.How can you benefit from a payment reconciliation system?

An automated payment reconciliation system would help sellers track their payments for every order received. This saves sellers the headache of having to manually reconcile everything on a spreadsheet, increases efficiency and gives the seller better insight into their financial data. A typical e-commerce payment reconciliation system is able to track various payments and deductions of the business, here are some examples: shipping overcharged, commission overcharged, inventory missing without reimbursement, pick-pack overcharges etc.Conclusion

In conclusion, it is vital to first ensure that reconciliation files are error-free and that you have collected all of your money. The process in itself poses many challenges and it is evident that a higher degree of automation can make the process more efficient. Therefore, one first needs a convenient mechanism to gather all files from different acquirers and payment methods into one place. Thereafter, one should adopt a standard format to convert and consolidate all of the dispersed files into a single file. This file can now be utilized by the accountants for reconciliation.No more unmatched transactions or missing funds! Wouldn’t it be great if payment reconciliation could be done in a single click? Celeris offers Automated Reconciliation as a part of our Payment Gateway service. Reach out to us at [email protected] to find out more about these features.

Let's Connect

Just a few quick details. Our team will reach out to explore how our platform fits your payment stack and objectives.

Talk with one of our payment experts

Ready to elevate your business to new heights? Schedule a call with our experts to discuss your unique needs and uncover tailored solutions. Don’t let questions linger – seize the opportunity to pave your path to success!

Winner !

Best use of data analytics, MPE 2025

Best Payments Orchestration Solution, MPE 2024