Verifi specializes in dispute management, aiding sellers in revenue retention and cost reduction from banks.

- Resource

- /

- The Keys to Unlocking Subscription Payment Success

Contents

Recommended Articles

What is Payment Orchestration? A Complete Guide for Businesses in 2026

December 9 2025 | Blog

A Payment orchestration is a software layer that connects your business to multiple payment service providers, acquirers, banks and other financial services through a single platform, it allows you to manage transactions across various partners and optimises success...

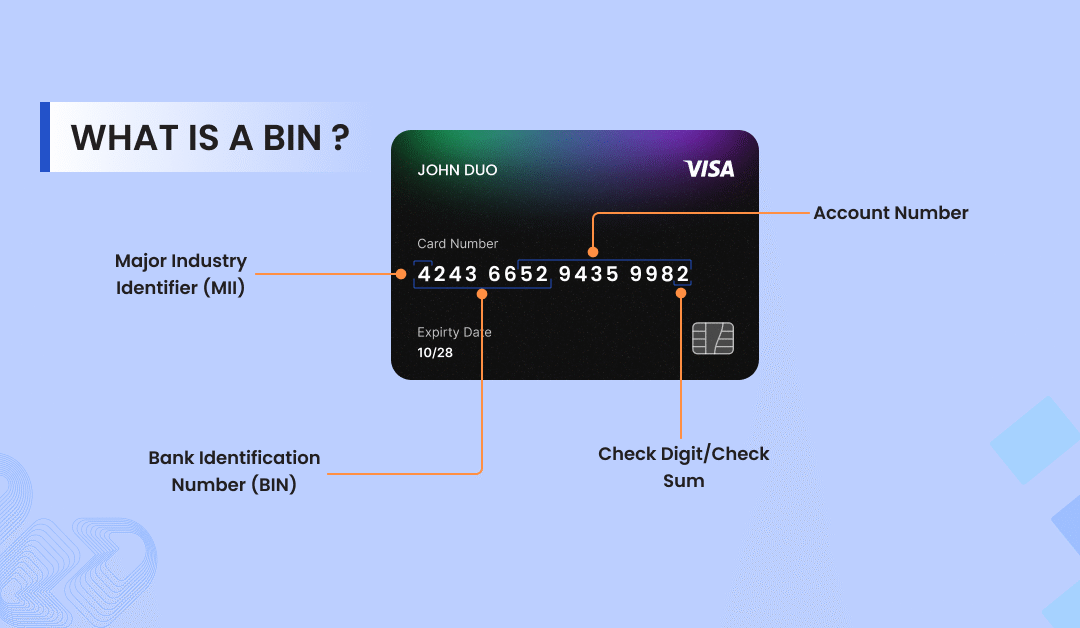

What is BIN in Card Payments? A Guide Every Merchant Need

November 26 2025 | Blog

Most businesses today close sales through conversations, not just via websites or apps. Customers interact with your brand across various channels, including Instagram, WhatsApp, email, and live chat.

Pay by Link: A Smarter Way to Accept Payments in 2025

July 31 2025 | Blog

Most businesses today close sales through conversations, not just via websites or apps. Customers interact with your brand across various channels, including Instagram, WhatsApp, email, and live chat.

Share This Post

The Keys to Unlocking Subscription Payment Success

By Chetan Chadha on 30/01/2025

In today’s digital economy, subscription-based models have become essential for businesses seeking consistent revenue and lasting customer relationships. However, the success of these models depends on an advanced subscription payment gateway for a seamless and efficient payment process. Building upon industry insights and aligning with the expertise of Celeris, this article delves into five critical aspects of subscription billing success and payment optimization, highlighting key approaches to ensure success throughout the recurring billing cycle.

Read more: what is subscription payment gateways?

Contents

Enhancing Conversion Through Streamlined Customer Experience

Getting it right at the start of the customer journey is essential, a frictionless payment experience is crucial for converting potential customers, this is even more important when looking to convert subscribers into loyal long term customers. Complex, clunky and lengthy payment processes can deter users, leading to poor customer conversion and ultimately lost revenue.

-

Minimise Clicks: Simplifying the payment journey significantly impacts conversion rates. For instance, in 2022, digital media and entertainment platforms achieved the highest conversion rates among subscription-based industries, at 43.3%. We have also explored the success of the latest Hosted Field solutions in our recent blog, Optimising Checkout Experiences: A Guide to Improving Payment Conversion. This highlights the importance of the checkout getting it right can increase conversion by up to 38%.

-

User-Friendly Design: An intuitive, straightforward and simple payment interface reduces friction, encouraging users to complete their transactions.

-

Clear Communication: Providing transparent information about pricing, billing cycles, and any additional charges builds trust and reduces the likelihood of cart abandonment.

Leveraging Technology for Enhanced Conversion

Employing the right technological solutions is vital for catering to diverse customer preferences and maximising conversion rates.

-

Appropriate Payment Methods: Offering a variety of payment options, including Alternative Payment Methods (APMs), caters to regional preferences and enhances customer satisfaction. Notably, 82% of subscribers stated that the ability to pay using their preferred payment methods was one of the features they wanted most from merchants.

-

Recurring Payment Support: Implementing solutions that facilitate seamless transition of initial customers into recurring transactions ensures uninterrupted service for subscribers. Providing the right journey and simple automated way via technology to take the initial purchase into an enrolled subscriber is essential for success and revenue optimisation.

-

Mobile-Centric Solutions: With recent research indicating that 45% of all global ecommerce transactions are from a mobile device, not having a mobile first approach is hampering conversion, optimising the payment process for mobile platforms is essential along with adopting mobile optimised payment methods such as Apple Pay and Google Pay, these are both increasing conversion by 15% whilst reducing fraud.

-

Flexibility: Adapting to various customer needs by offering multiple payment plans, currencies, and payment frequencies enhances conversion rates.

Ensuring Secure and Successful Payment Acceptance

Security and reliability are paramount in payment processing. Implementing robust measures ensures payments are accepted securely and efficiently.

-

Card Validation Solutions: Utilising tools that verify card details in real-time prevents errors and reduces declined transactions. This allows cardholder details to be validated, secured and retained for use later in the subscription payment cycle.

-

Strong Customer Authentication (SCA): Implementing these protocols adds layers of security, protecting against fraud while complying with regulatory requirements for recurring billing. Furthermore, when implemented correctly this increases approval. Using the unique Celeris 3DS Flex solution provides a dual MPI based solution built to maximise acceptance whilst providing exceptional customer experience but also be agnostic to processing bank providing further cost optimisation. Do not forget that Apple Pay and Google Pay are also SCA which drives added security and greater customer experience.

-

Fraud Detection Systems: Deploying advanced analytics to monitor transactions for suspicious activity safeguards both the business and its customers. Celeris’s advanced risk rules give businesses the ability to control and manage transaction acceptance, helping to keep the good in but the bad out and tailored to each customer as every customer and transaction is different.

-

Supporting Customer Everywhere: As your business grows internationally, putting the transaction to the right place and the right time, it sounds simple but it isn’t. Celeris excels here with a combination of solution that improve acceptance and drive revenues this include:

-

Retries, logic to retry certain transaction failures can uplift acceptance by up to 7%.

-

Cascading, lthis is where it gets more interesting, using a multi-acquirer strategy to try certain failed transactions with an alternative provider, on average Celeris see up to 20% improved acceptance when implemented.

-

Advanced transaction routing, Celeris comes into its own here, using the actual transactional data to make a real-time decision of where the transaction is best sent to optimise the chance of a successful payment.

-

Optimising Post-Initial Payment Processes

As discussed, the subscription journey extends well beyond the initial payment. Optimising post-payment processes is crucial for maintaining customer satisfaction, operational efficiency and maintaining revenue.

-

Comprehensive Subscription Management Platform: Utilising a platform that is built for payment processing coupled with subscription management allows for an optimised automated billing solution. Payment failures will happen. It is how you respond to those failures that saves lost revenue and delivers great customer experience. Celeris’s Subscription Recovery Rules delivers a unique solution that allows customised and transactional driven decision making on subscription failures, whether the time of day, day of the week, amount or based on bank response codes each transaction can be retried to ensure successful collection.

-

Focus on Payment Continuity: Ensuring that recurring payments are processed without interruption provides consistent service to subscribers.

-

Customer Communication: Keeping subscribers informed about billing dates, payment confirmations, and any issues fosters transparency and trust.

Mitigating Payment Failures to Preserve Revenue and Customer Experience

Payment failures can lead to revenue loss and negatively impact customer satisfaction. Implementing strategies to mitigate these failures is essential.

-

Advanced Rebilling Strategies: Celeris has created an automated system that can respond to payment declines by retrying transactions based on specific decline codes and reasons, adjusting rebill timing and the amount or offering alternative payment options can significantly reduce churn. Notably, Nearly 40% of subscriber churn happens because of payment failure, leading to substantial revenue loss.

-

Card Updater Services: Implementing services that automatically update expired or replaced failing card details prevents payment disruptions improve subscription success.

-

Data Analysis: Regularly analysing transaction data to identify patterns in payment failures allows for strategic adjustments to improve success rates.

By focusing on these five areas, businesses can unlock the full potential of their subscription payment systems, ensuring a seamless, secure, and satisfying experience for their customers.

Looking to enhance your subscription operations then feel free to get in touch here and speak to one of the Celeris team.

Let's Connect

Just a few quick details. Our team will reach out to explore how our platform fits your payment stack and objectives.

Talk with one of our payment experts

Ready to elevate your business to new heights? Schedule a call with our experts to discuss your unique needs and uncover tailored solutions. Don’t let questions linger – seize the opportunity to pave your path to success!

Winner !

Best use of data analytics, MPE 2025

Best Payments Orchestration Solution, MPE 2024