Verifi specializes in dispute management, aiding sellers in revenue retention and cost reduction from banks.

- Resource

- /

- Transforming Payments for Sustainable Innovation

Intellforce & Celeris

Transforming Payments for Sustainable Innovation

Last Updated April 22, 2025

Contents

Recommended Articles

What is Payment Orchestration? A Complete Guide for Businesses in 2026

December 9 2025 | Blog

A Payment orchestration is a software layer that connects your business to multiple payment service providers, acquirers, banks and other financial services through a single platform, it allows you to manage transactions across various partners and optimises success...

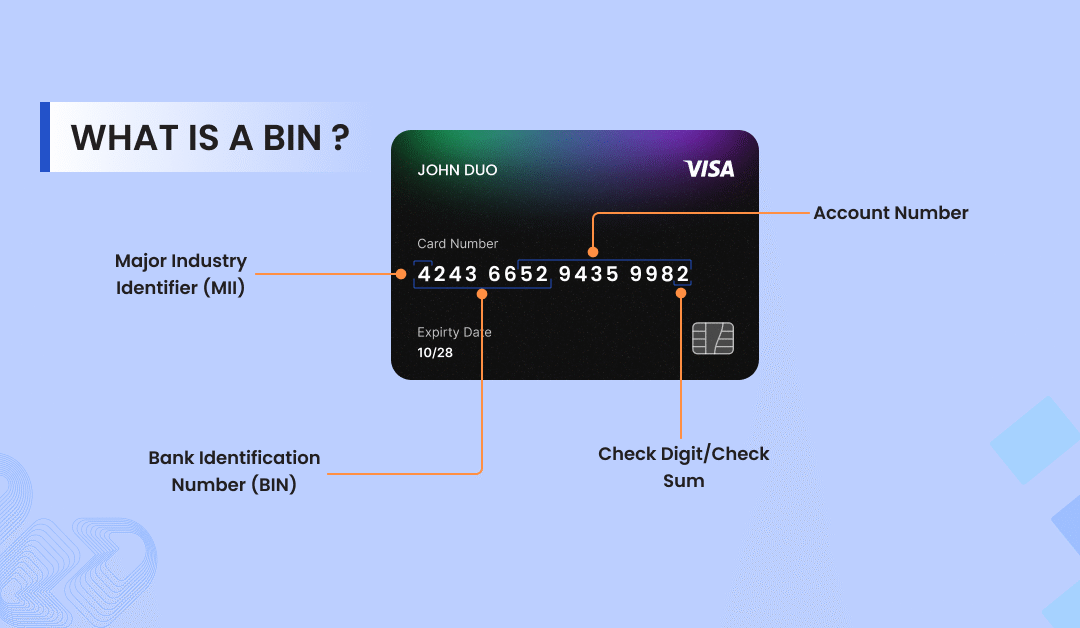

What is BIN in Card Payments? A Guide Every Merchant Need

November 26 2025 | Blog

Most businesses today close sales through conversations, not just via websites or apps. Customers interact with your brand across various channels, including Instagram, WhatsApp, email, and live chat.

Pay by Link: A Smarter Way to Accept Payments in 2025

July 31 2025 | Blog

Most businesses today close sales through conversations, not just via websites or apps. Customers interact with your brand across various channels, including Instagram, WhatsApp, email, and live chat.

Share This Post

Intellforce, a leading e-commerce company specialising in managing B2C subscription billing solutions, faced mounting challenges in managing its internal payment platform. Rising costs from evolving technologies, stringent compliance demands, and the necessity for innovation prompted the company to partner with Celeris. This collaboration aimed to revamp Intellforce’s payment processes effectively.

By optimising checkout conversions, Intellforce witnessed a remarkable 17% increase in customer conversions. Acceptance optimisation further enhanced the customer payment acceptance rate by 8%, significantly improving performance. These enhancements enriched the customer experience and significantly increased results, enabling Intellforce to refocus on its core business

Contents

Key Challenges Faced by Intellforce

-

Complexity and Cost of Payment Infrastructure: Managing an in-house payments platform, Intellforce struggled with the complexity of multiple acquiring connections. The diverse array of payment providers introduced inconsistency and rising operational costs, making managing increasingly tricky and time-consuming.

-

Slower Speed of Innovation: Keeping pace with market demands, such as integrating Apple Pay and Google Pay, proved challenging. This complexity delayed delivering new features to customers, hindering the company’s competitive edge.

-

Shifting Compliance Landscape: The rapid evolution of secure payment requirements, including Strong Customer Authentication (SCA) and PCI standards, created a continual challenge for Intellforce. Complying with these regulations diverted critical resources and focus from their core business operations.

-

Centralised Reporting and Risk Management: The fragmented management of multiple providers limited visibility into fraud alerts and disputes, complicating risk management efforts across the organisation.

-

Distraction from Core Business Functions: Intellforce’s primary focus is enhancing its customer experience and subscription offerings, yet maintaining a payment platform diverts essential resources and attention

Why Choose Celeris as a Partner?

Intellforce selected Celeris, an award-winning payment orchestration provider, to streamline its operations. By delegating payment orchestration to Celeris, Intellforce could concentrate on improving its subscription billing platform, supported by a single integration covering over 65 global acquirers and 100+ payment methods. With Celeris, they optimised existing acquirer relationships and expanded into new markets.

Innovative Technology and Integrations

Celeris offers an AI-driven platform with advanced features to optimize payment approval rates. This technology significantly improved payment acceptance rates and enhanced the overall customer experience. The integration of newer payment methods, including Apple Pay and Google Pay, not only facilitated recurring collections but also resulted in a boost in revenue.

Rapid Market Entry and Global Payment Solutions

The single integration approach allowed Intellforce to swiftly deploy multiple payment options, including Apple Pay and Google Pay, thus reducing market entry time for these solutions. Utilising these modern payment methods yielded an 8% increase in acceptance rates compared to traditional card-only transactions, paving the way for broader market engagement and local acquiring opportunities.

3DS Flexible—A Cutting-Edge Authentication Solution

Celeris’s dual authentication approach improved transaction security, enhancing authentication rates by 4%. This innovation minimised friction for end customers while maintaining security standards across various acquirers.

Dynamic Routing and Transaction Optimisation

Leveraging Celeris’ AI-driven subscription billing module, Intellforce implemented custom billing cycles with flexible auto-retry options.

Platform Insights and Enhanced Data Analysis

Celeris’ built-in AI-driven data analysis tools empower Intellforce to interpret transaction data efficiently. This capability simplifies reconciliation, thereby improving overall operational efficiency.

I am really impressed with the professionalism in managing our accounts by the team Celeris. I can truly say that their performance is top notch that I experienced so far. “Head of Risk – Intellforce”

Conclusion

Through its partnership with Celeris, Intellforce has significantly enhanced its payment processes while reducing the complexities and distractions of managing an in-house payment platform. The collaboration has improved customer experience and retention rates and amplified Intellforce’s productivity, positioning the company for sustainable growth in the competitive e-commerce landscape. Intellforce solidifies its commitment to delivering innovative and tailored solutions that drive user satisfaction and business success by focusing on its core subscription billing services

Related Resource

Related Resource