Verifi specializes in dispute management, aiding sellers in revenue retention and cost reduction from banks.

Asked

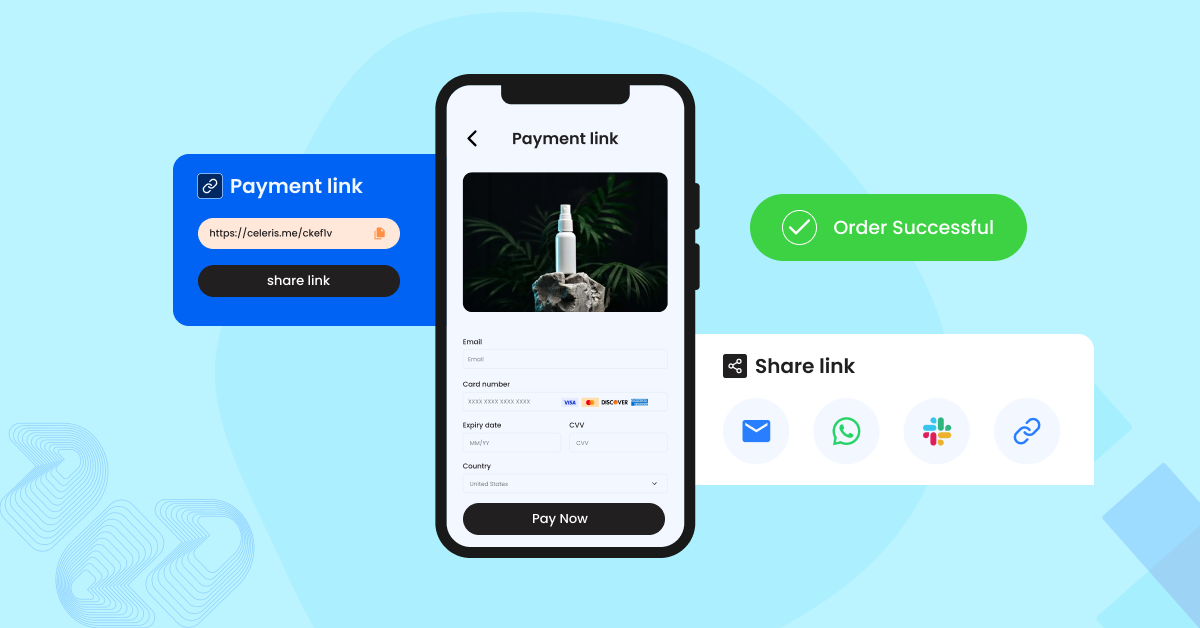

Can I accept different payment methods through one link?

Yes, Your customers can choose from UPI, card, wallet, or open banking when they open the link.

How soon will I receive funds?

Is Pay by link secure?

Can I brand the checkout page?

What if I want to limit access to a link?

Can I automate this with APIs?

Let's Connect

Just a few quick details. Our team will reach out to explore how our platform fits your payment stack and objectives.

Talk with one of our payment experts

Ready to elevate your business to new heights? Schedule a call with our experts to discuss your unique needs and uncover tailored solutions. Don’t let questions linger – seize the opportunity to pave your path to success!

Winner !

Best use of data analytics, MPE 2025

Best Payments Orchestration Solution, MPE 2024