Verifi specializes in dispute management, aiding sellers in revenue retention and cost reduction from banks.

- Resource

- /

- Exploring Celeris Virtual Terminal: Simplified Payment Processing for Businesses

Contents

Recommended Articles

What is Payment Orchestration? A Complete Guide for Businesses in 2026

December 9 2025 | Blog

A Payment orchestration is a software layer that connects your business to multiple payment service providers, acquirers, banks and other financial services through a single platform, it allows you to manage transactions across various partners and optimises success...

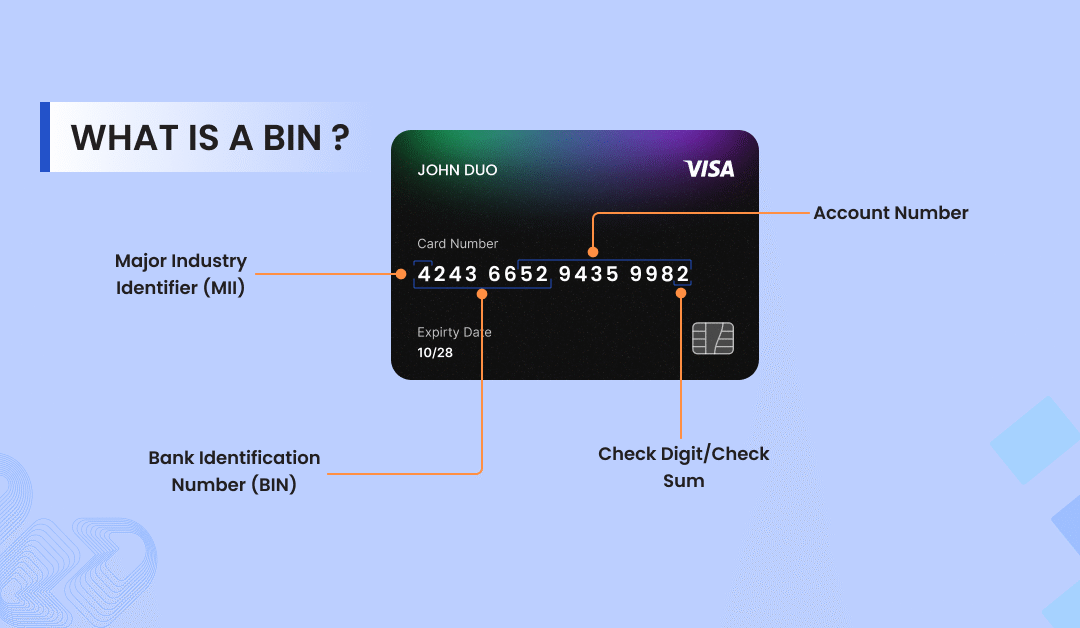

What is BIN in Card Payments? A Guide Every Merchant Need

November 26 2025 | Blog

Most businesses today close sales through conversations, not just via websites or apps. Customers interact with your brand across various channels, including Instagram, WhatsApp, email, and live chat.

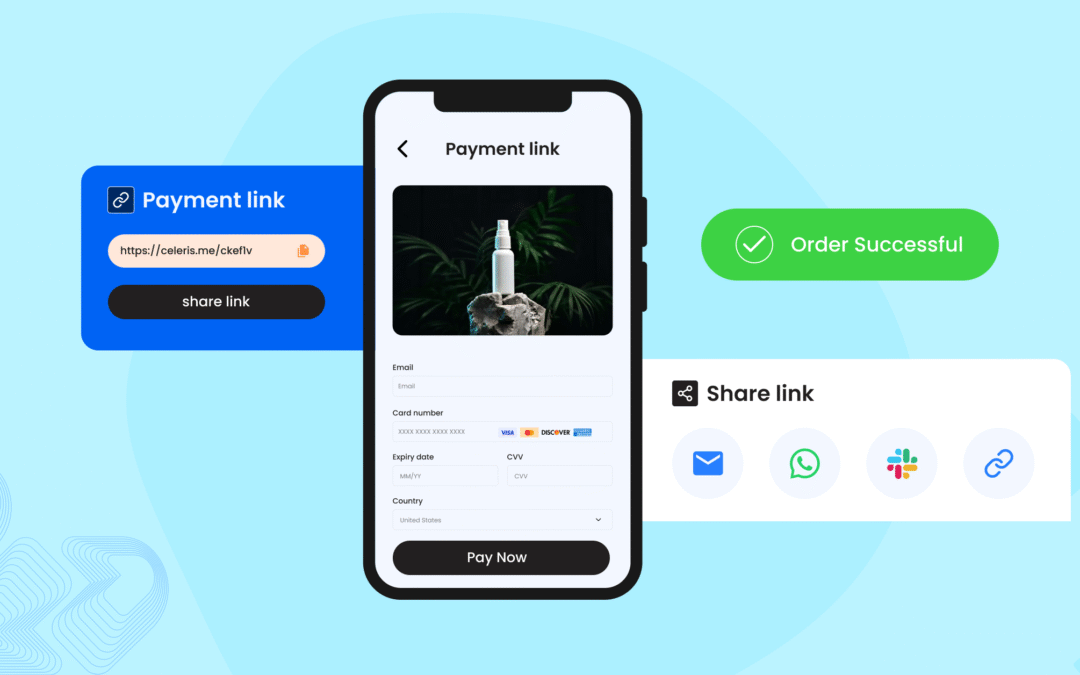

Pay by Link: A Smarter Way to Accept Payments in 2025

July 31 2025 | Blog

Most businesses today close sales through conversations, not just via websites or apps. Customers interact with your brand across various channels, including Instagram, WhatsApp, email, and live chat.

Share This Post

Exploring Celeris Virtual Terminal: Simplified Payment Processing for Businesses

By Chinmay Jain on 23/10/2023

Contents

Introduction

In the rapidly evolving landscape of e-commerce and digital transactions, businesses of all sizes are seeking efficient and secure payment processing solutions. Celeris Virtual Terminal stands out as a transformative solution, providing a simplified approach to payment management, improving customer experiences, and streamlining operations.

Understanding Celeris Virtual Terminal

Celeris, a leading Payment Service Provider, introduces its Virtual Terminal as an innovative tool that empowers businesses to accept payments conveniently, both online and in person. The Virtual Terminal serves as a web-based interface that allows merchants to process various payment methods, making it an ideal solution for businesses with varying customer preferences.

Maximizing Business Potential: Virtual Terminal Benefits for Merchants

Merchants require a virtual terminal for various reasons, as it offers them a versatile and efficient way to process payments and manage their business operations. Here are some key reasons why merchants always choose to use a virtual terminal:

1. Diverse Payment Channels:

A virtual terminal allows merchants to accept payments through various channels, including phone orders, mail orders, and even face-to-face transactions. This flexibility enables businesses to cater to different customer preferences and expand their revenue streams.

2. Global Reach:

With a virtual terminal, merchants can process payments from anywhere with an internet connection. This eliminates geographical limitations and enables businesses to serve customers around the world, making it especially valuable for e-commerce and remote service providers.

3. No Physical Hardware Required:

Unlike traditional point-of-sale systems that require physical card terminals, a virtual terminal operates entirely online. This eliminates the need for purchasing and maintaining costly hardware, reducing overhead expenses.

4. Real-Time Reporting:

Virtual terminals provide merchants with real-time access to transaction data and reports. This enables them to monitor their business performance, track sales trends, and make informed decisions based on up-to-date information.

5. Simplicity and Convenience:

Virtual terminals are user-friendly and require minimal technical expertise to operate. This makes them accessible to businesses of all sizes and types, from small startups to larger enterprises.

6. Enhanced Customer Experience:

Virtual terminals enable merchants to process payments quickly and efficiently, leading to smoother transactions and a more positive customer experience. This can contribute to customer satisfaction and loyalty.

7. Compliance and Security:

Virtual terminal offers enhanced security measures and ensures compliance with industry standards (PCI DSS Level 1), thereby enabling merchants to safeguard the confidentiality of customer payment data and comply with payment regulations.

Tailored Virtual Terminal: Unleashing Customization Capabilities

In Celeris virtual terminal, customization refers to the ability for merchants to tailor the payment processing experience according to their specific preferences and needs. Here’s how the customization features in Celeris virtual terminal work:

Branding and Appearance:

Merchants can customise the virtual terminal’s interface to match their brand’s aesthetics. This includes uploading a logo, choosing colour schemes, and adjusting the overall visual layout. This ensures that the payment page aligns with the merchant’s brand identity, creating a seamless and consistent customer experience.

Payment Options:

Merchants can customise the types of payment methods they want to accept through the virtual terminal. This includes credit, debit cards, digital wallets or local payment methods. This flexibility enables merchants to cater to their customers’ preferred payment option. Virtual terminal can be used to initiate payouts to customers. Instead of physically sending cheques or making manual bank transfers, the merchant can log into the virtual terminal and initiate the payout process electronically.

Fields and Information:

Virtual terminals typically allow merchants to customise the fields they require customers to fill in during the payment process. This customization can help streamline the checkout process by only requesting necessary information, reducing friction and increasing conversion rates.

Reporting and Analytics:

Customizable reporting features allow merchants to generate specific reports that align with their business needs. This might involve selecting certain transaction data, timeframes, or filters to gather insights that are most relevant to their operations.

Language and Localization:

If the merchant operates in different regions or countries, customization could extend to providing language options or adapting the virtual terminal to local preferences, including currency formats and date conventions.

Summary

The Celeris Virtual Terminal is a game-changing solution that streamlines payment processing for businesses of all sizes. This innovative tool simplifies and enhances the way companies handle transactions, making it easier than ever to accept payments from customers. With its user-friendly interface and robust features, Celeris Virtual Terminal empowers businesses to efficiently manage their financial transactions, improving operational efficiency and customer satisfaction. Explore how this cutting-edge technology can transform your payment processing experience and drive growth for your business.

Contact us today to learn more about our Celeris Virtual Terminal and how it can transform your payment integrations. Together, let’s unlock the true potential of your online business and embark on a seamless integration journey with Celeris.

Do you have any follow-up questions after reading this article? Reach out to us; we will gladly help you find the answers. Fill out the form below, and we will contact you shortly. Or drop us an email at [email protected].

Let's Connect

Just a few quick details. Our team will reach out to explore how our platform fits your payment stack and objectives.

Talk with one of our payment experts

Ready to elevate your business to new heights? Schedule a call with our experts to discuss your unique needs and uncover tailored solutions. Don’t let questions linger – seize the opportunity to pave your path to success!

Winner !

Best use of data analytics, MPE 2025

Best Payments Orchestration Solution, MPE 2024