Verifi specializes in dispute management, aiding sellers in revenue retention and cost reduction from banks.

- Resource

- /

- What you should know about Intelligent Transaction Routing (ITR)

Contents

Recommended Articles

What is Payment Orchestration? A Complete Guide for Businesses in 2026

December 9 2025 | Blog

A Payment orchestration is a software layer that connects your business to multiple payment service providers, acquirers, banks and other financial services through a single platform, it allows you to manage transactions across various partners and optimises success...

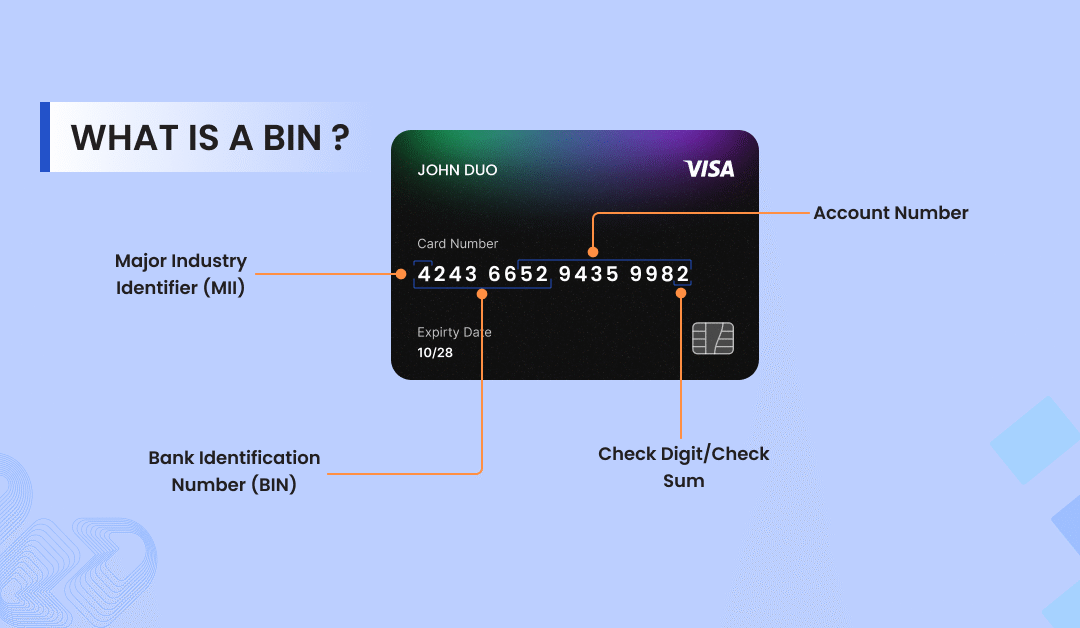

What is BIN in Card Payments? A Guide Every Merchant Need

November 26 2025 | Blog

Most businesses today close sales through conversations, not just via websites or apps. Customers interact with your brand across various channels, including Instagram, WhatsApp, email, and live chat.

Pay by Link: A Smarter Way to Accept Payments in 2025

July 31 2025 | Blog

Most businesses today close sales through conversations, not just via websites or apps. Customers interact with your brand across various channels, including Instagram, WhatsApp, email, and live chat.

Share This Post

What you should know about Intelligent Transaction Routing (ITR)

By Chinmay Jain on 25/08/2020

Contents

Introduction

In 2021, e-commerce is predicted to account for 18.1% of the global retail sales, one of the highest percentages in a single year. As international e-commerce offers many opportunities for global business expansion, it also presents a highly competitive market. Optimizing payment success rates, decreasing the cost of transactions, and maintaining redundancy during the payment process are a few challenges that online merchants might face. One solution is the use of Intelligent Transaction Routing (ITR), a technology of growing interest in the last years.

What is Intelligent Transaction Routing (ITR)?

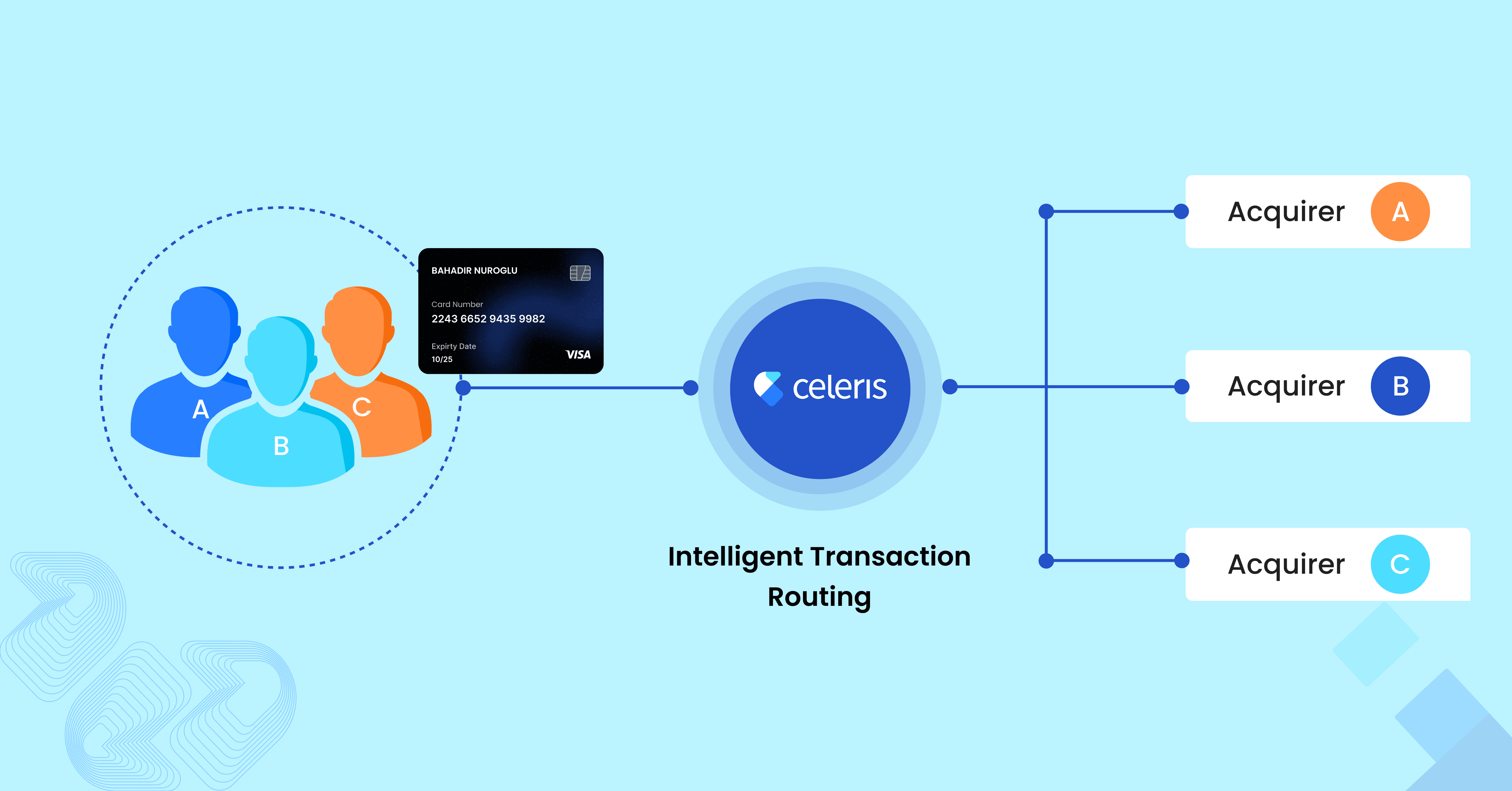

Intelligent Transaction Routing (ITR), also known as cascading transaction routing, can be defined as a flexible process engine that dynamically manages the transaction flow.

Via a payment network, ITR ensures that each transaction routes to the acquiring bank that is most likely to approve it quickly. In the case of a fail-over transaction, where the payment cannot proceed further, the system will automatically find a secondary acquiring bank that might authorize the transaction. All retries happen in real-time and are invisible to the customer.

Additionally, merchants can set predefined rules based on various criteria. BINs, volume, country, and fee are examples of criteria used by ITR to determine the most suitable acquirer, according to their needs. With some providers, merchants can also track the routing and monitor the entire process with total transparency.

The 3 Top Benefits of Implementing Intelligent Transaction Routing (ITR)

When it comes to delivering a friction-less experience online, merchants should not neglect the customers’ payment process. Everything else in the customer journey can be executed perfectly, but if the actual payment runs afoul, all other optimizations have been done in vain. Intelligent Transaction Routing (ITR) can be an extra factor in preventing discontinuity in the transaction flow.

- The primary advantage is an increase in the payment success rate. With different customization and automation levels available, ITR automatically determines each transaction’s optimal route, allowing merchants to effectively expand their international customer base and achieve the highest payment success rate. If operations at an acquirer shut down due to technical or financial reasons (e.g., bankruptcy), the ITR will send the transaction to the acquirer that will likely approve it. The Paypers says merchants recovered more than 15% of failed transactions with transaction routing engines.

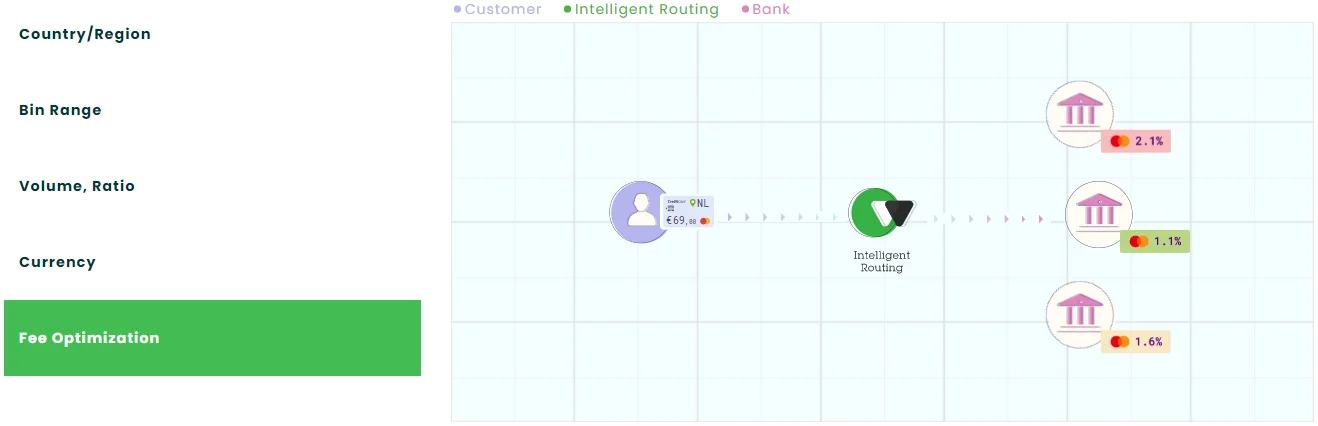

- The secondary advantage is the minimization of transaction costs. Having multiple acquirers means different commercial agreements and multiple fee structures. ITR can help merchants in smartly routing the transactions to the acquirer that offers the most optimal fee. The figure below illustrates a situation where three different acquirers charge various percentages of fees, ranging from 1.1% to 2.1%, and the routing system selects the one that charges the lowest fee. Additionally, ITR can route all payments to local acquirers, eliminating cross-border and currency conversion fees for international transactions.

- Another advantage is that ITR can offer customers an improved online experience. According to a survey by Business Insider, more than 30% of cardholders will stop shopping after a single payment decline. However, with ITR and automatic retries, the risk of a failed payment decreases, and the customer is saved the hassle of retrying the payment.

The Benefits of Implementing ITR with a White-label Payment Platform

Although the benefits discussed in the section above are great, Intelligent Transaction Routing (ITR) can add a layer of complexity to payment processes. A white-label payment platform might be an optimal choice to provide merchants with a competitive solution in a very short time. This refers to a Payment Orchestration Platform, which allows merchants to enhance their payment infrastructure and maximize their payment performance through unique API integration. Hereby, a list of the various advantages of using one.

Quick multi-acquirer setup

A celeris solution can offer one single connection to many acquirers all over the world. The acquirers’ portfolio can be integrated, depending on the merchants’ setup, in a few hours or days. This allows merchants almost instantaneously to utilize the benefits of ITR and maximize their revenues.

Customization

ITR can further facilitate the payment process by allowing the merchants to set different rules with priorities based on ratio, BINs, country, or other demographics. For instance, it can determine the share of transaction volume that each acquirer will receive to ensure that the one with the highest performance, will handle the essential parts of the transactions.

Data analytics

With Celeris, merchants can access a modern centralized processing platform that gathers detailed transaction information across all channels and all geographies. This will provide merchants with the acquirer’s success rate, the origin of all transactions, how many times the customer retried the payment, and why it failed. Further routing information will also be available for detecting issues and setting strategic routing rules for future planning.

Other features to enhance the payment process

Celeris offers a wide range of features. Besides the Intelligent Transaction Routing (ITR), automated reconciliation and in-depth reporting can be easily integrated. Due to the increasing volume of online transactions, fraudulent activities increased. Although it is unlikely to eliminate the threat of fraud, the Celeris platform can help merchants protect their customers while minimizing their transaction costs. In the case of illegitimacy, the software will block the transaction before sending it to the acquirer bank, saving fees and other costs.

Takeaways

Intelligent Transaction Routing (ITR) is an engine of great benefit to both merchants and their customers. While merchants benefit from higher payment success rates and lower transaction costs, customers benefit from an uninterrupted payment experience.

In summary, ITR can be a quick win to optimize the payment process, but companies should consider the time and effort needed to implement it. Relying on the Celeris platform can represent a step toward unlocking new growth opportunities for merchants while improving the checkout experience for customers in a much shorter time.

Let's Connect

Just a few quick details. Our team will reach out to explore how our platform fits your payment stack and objectives.

Talk with one of our payment experts

Ready to elevate your business to new heights? Schedule a call with our experts to discuss your unique needs and uncover tailored solutions. Don’t let questions linger – seize the opportunity to pave your path to success!

Winner !

Best use of data analytics, MPE 2025

Best Payments Orchestration Solution, MPE 2024